2. Creation of Current Account

Oracle FLEXCUBE facilitates account opening from different sources. This chapter discusses and takes you through the available options, stages involved and account opening workflow. In the first section, the chapter briefs you on the process involved. The next section talks about the steps involved in detail.

This chapter contains the following sections:

- Section 2.1, "Account Creation Process"

- Section 2.2, "Lead Requests Process"

- Section 2.3, "Lead Maintenance Fields Validations"

- Section 2.4, "Stages for Request Received through Branch (BPMN)"

- Section 2.5, "Receive and Account Opening Form and Documents"

- Section 2.6, "Seek Approval for Missing Documents / Details"

- Section 2.7, "Modifying and Resubmit the Application"

- Section 2.8, "Input Details of Current Account"

- Section 2.9, "Verify Details of Current Account"

- Section 2.10, "Modify Details of Current Account"

- Section 2.11, "KYC_C Review Info"

- Section 2.12, "Block Customer in the System"

- Section 2.13, "Notify Customer on Negative Status of KYC Checks"

- Section 2.14, "Create / Modify Customer Details in Oracle FLEXCUBE"

- Section 2.15, "Create Account"

- Section 2.16, "Store Document Reference in FLEXCUBE"

- Section 2.17, "Check Available Balance"

- Section 2.18, "Generate Cheque Book"

- Section 2.19, "Retrieve Pre-printed Cheque Book"

- Section 2.20, "Issue Debit Card"

- Section 2.21, "Generate Welcome / Thank You Letter"

- Section 2.22, "Notify the customer/prospect about the successful account opening with details"

- Section 2.23, "Deliver Account Kit to the Customer"

- Section 2.24, "Store Documents"

- Section 2.25, "Auto Closure of Leads"

2.1 Account Creation Process

The process of creating a current account begins with a bank receiving an account opening application and the related documents from a customer. A bank can receive this application either from a:

- Prospect – On receiving the request, customer is created in ‘Customer Maintenance’ screen and customer account is created at ‘Customer Maintenance’ screen. After the successful creation of customer and account, the prospect is informed about it. If the KYC check is not passed, then the application is rejected.

- Existing Customer – While opening an account for an existing customer, the bank checks KYC details, only if there are any changes in the existing KYC information of the customer. If the KYC check is not passed the application is rejected after blocking the existing accounts.

For a customer who passes the KYC check, the customer ID is created/ updated and the customer account is opened in the relevant system and the kit is dispatched

Prospect/customer can contact bank either through

- Channel – A request to open an account can be through any of

the following routes.

- Lead Request

Account opening through BPMN.

- Lead

Account opening through standard account opening process

- Lead Request

- Branch – A request to open an account is through BPMN.

After receiving a request, the bank verifies whether the details/documents required to process the request are available. If any documents are missing, then the bank will either decide to proceed after obtaining the missing details/documents or to process the request without waiting for the missing details/documents, with necessary approvals.

The following sections provide details on the process followed for Lead Maintenance and BPMN workflow.

2.2 Lead Requests Process

This section contains the following topics:

- Section 2.2.1, "Processing Lead Requests"

- Section 2.2.2, "Main Tab"

- Section 2.2.3, "Details Tab"

- Section 2.2.4, "Financial Tab"

- Section 2.2.5, "Requested Tab"

- Section 2.2.6, "Document Details"

2.2.1 Processing Lead Requests

Lead requests received from a prospective customers are handled at Lead Maintenance level and the facility is available to external channels as a service. As mentioned earlier, for a lead record, customer and account are created directly through Customer Information and Customer Account Creation screens respectively or through BPMN workflow.

Lead requests from an existing customer are also handled a Lead Maintenance level. However, for a lead record for an existing customer, the requested account is created directly through Customer Account Creation screen or BPMN workflow.

You can maintain the details of a prospective/existing applicant, when the applicant initially approaches the bank to open an account. The system facilitates capturing of lead details through external channels as well.

The following details are captured as part of this maintenance:

- Prospective/existing customer’s personal and location details

- Prospective/existing customer’s employment details

- Lead life cycle management

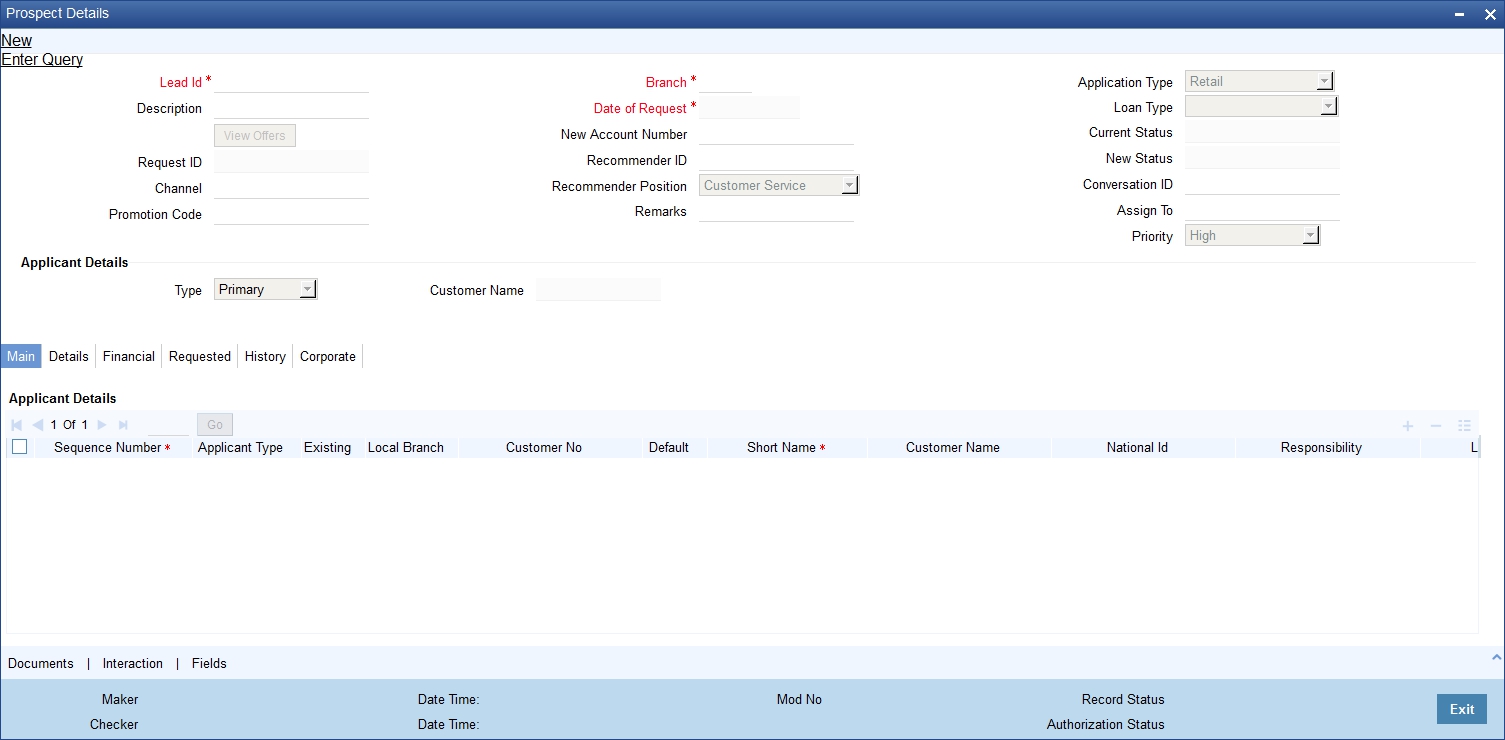

You can invoke this screen by typing ‘ORDLEADM’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details in this screen:

Lead Id

Specify a unique identification for the prospective customer.

Description

Specify a suitable description for the prospective customer.

Request ID

The system displays the request identification of the request.

Channel

The system by default displays ‘FLEXCUBE’ as the channel. However, you can modify if needed. The adjoining option list displays a list of valid channels. Select the appropriate one.

Date of Request

Specify the date when the prospective customer enquired about the account. You can also select the date from the adjoining ‘Calendar’ icon.

Application Type

Select the application type as ‘CASA’ from the adjoining drop-down list.

Current Status

The system displays the current status of the lead.

New Status

Select the new status from the adjoining option list. It is mandatory to specify the reason if the current status is ‘Closed’, ‘Rejected’ or ‘Additional Document Required’.

After authorization, the new status becomes the current status of the lead.

Conversation ID

Specify the conversation ID, if conversation is originated before the lead record submission. The adjoining option list displays all valid conversation IDs. Select the appropriate one.

Recommender ID

Select the user ID of the employee who is referring the customer from the adjoining option list.

Recommender Position

Select the position of the employee who is referring the customer from the adjoining drop-down list.

Remarks

Specify remarks, if any.

Assign To

Select the user ID of the person who will follow up on the lead.

Priority

Select the priority of follow up on the lead request from the adjoining drop-down

2.2.2 Main Tab

You can capture the following personal and geographical details related to a prospective customer:

Sequence Number

The system displays the sequence number.Type

Select the type of the customer from the drop-down list provided. The following options are available:

- Primary

- Co-Applicant

Existing

Check this box, if the lead applicant is an existing customer.

Local Branch

Select the local branch of an existing customer from the adjoining option list.

Customer No

Specify the customer, if the Customer is existing. The adjoining option list displays all valid customer numbers. Select the appropriate one. If the Customer is prospect, then the system generates the new customer ID, by default.

Default

Click on default button to default the details on existing customer.

Short Name

The system defaults the Short name when default button is pressed, if the applicant is an existing customer. However, you can specify the short name, if the applicant is prospect.

Customer Name

The system defaults the Customer name when default button is pressed, if the applicant is an existing customer. However, you can specify the customer name, if the applicant is prospect.

National ID

Specify the national Id or country code of the customer or select the national Id from the option list provided.

Responsibility

Select the responsibility from the adjoining drop down list.

Liability

Specify the liability for all parties other than primary applicant.

City

Specify the city of the customer.If the lead is received from the channel (FCDB), then the city value is passed by the FCDB to FCUBS and is defaulted here.

Country

Specify the country of domicile of the customer or select the country code from the option list provided.

Nationality

Specify the country of which the customer is a national or select the country code from the option list provided.

Language

Specify the primary language of the customer or select the language from the option list provided.

Customer Category

Specify the category to which the customer belongs or select the customer category from the option list that displays all valid customer categories.

Financial Currency

Select the financial currency from the adjoining option list.

Mobile Number

Specify the mobile phone number of the prospective customer.

Landline Number

Specify the land phone number of the prospective customer.

Home Phone ISD+

Select the area code for the home phone number from the adjoining option list.

Home Phone

Specify the home phone number with area code.

Specify the e-mail Id of the prospective customer.

Fax

Specify the fax number of the prospective customer.

Preferred Date of Contact

Specify the preferred date of contact.

Preferred Time of Contact

Specify the preferred time of contact.

First Name

Specify the first name of the customer.

Middle Name

Specify the middle name of the customer.

Last Name

Specify the last name of the customer.

Salutation

Select the salutation preference of the customer from the drop-down list provided. You can select any of the following options:

- Mr

- Mrs

- Miss

- Dr

Gender

Select the gender of the customer from the drop-down list.

Date of Birth

Specify the date of birth of the customer or select the date by clicking the ‘Calendar’ icon provided.

Mother’s Maiden Name

Specify the customer’s mother’s maiden name.

Marital Status

Select the marital status of the prospective customer from the drop-down list. The following options are available:

- Married

- Divorced

- Remarried

- Separated

- Spouse Expired

Dependants

Specify the number of dependants for the customer.

SSN

Specify applicant’s SSN.

Passport Number

Specify the passport number of the prospective customer.

Passport Issue Date

Specify the date on which the customer’s passport was issued or select the date from by clicking the adjoining ‘Calendar’ icon.

Passport Expiry Date

Specify the date on which the customer’s passport expires or select the date from by clicking the adjoining ‘Calendar’ icon.

Existing Relationship Details

You can maintain the following relationship details:

Relationship Type

Specify the relationship type of the customer.

Credit Card Number

Specify the credit card number of the customer

Customer ID/Account Number

Specify the customer identification or account number of the customer.

Note

The system defaults the above details for both the prospect and the existing customer, if the application is submitted from external system.

2.2.3 Details Tab

You can capture the address and employment related details of the prospective customer in ‘Details’ tab.

Address Details

Address Type

Select the address type of the customer from the following options provided in the drop-down list:

- Permanent

- Home

- Correspondence Address

Mailing

Check this box to indicate that the address you specify here is the customer’s mailing address.

Address Line 1 – 4

Specify the address of the customer in four lines starting from Address Line 1 to Address Line 3.

Pincode

Specify the zip code associated wit the address specified.

Contact Number

Specify the contact telephone number of the customer.

Country

Specify the country associated with the address specified.

Employment Details

Employer

Specify the name of the employer of the prospective customer.

Employment Type

Select the customer’s employment type from the drop-down provided. The following options are available:

- Part Time

- Full Time

- Contract Based

Occupation

Specify the occupation of the prospective customer.

Designation

Specify the designation of the prospective customer.

Employee Id

Specify the employee Id of the prospective customer.

Address Line 1 – 4

Specify the employment address of the customer in four lines starting from Address Line 1 to Address Line 4.

Country

Specify the country associated with the employment address specified.

Pincode

Specify the zip code associated with the office address specified.

Phone Number

Specify the official phone number of the prospective customer.

Extension

Specify the telephone extension number, if any, of the prospective customer.

Contact Phone

Specify the contact phone number of the customer’s contact person.

Contact Name

Specify the name of a contact person at the customer’s office.

Contact Extension

Specify the telephone extension number, if any, associated with contact person.

Department

Specify the department to which the customer belongs.

Comments

Specify comments, if any, related to the customer’s employment.

Business Details

Type of Business

Select the type of business from the adjoining drop-down list.

Name of Business

Specify the name of the company here.

Type of Ownership

Select the type of ownership from the adjoining drop-down list.

Others

Specify if the type of ownership is others.

Currency

Select the currency from the adjoining option list.

Annual Turnover

Specify the annual turnover of the company.

Business Description

Give a brief description on the company.

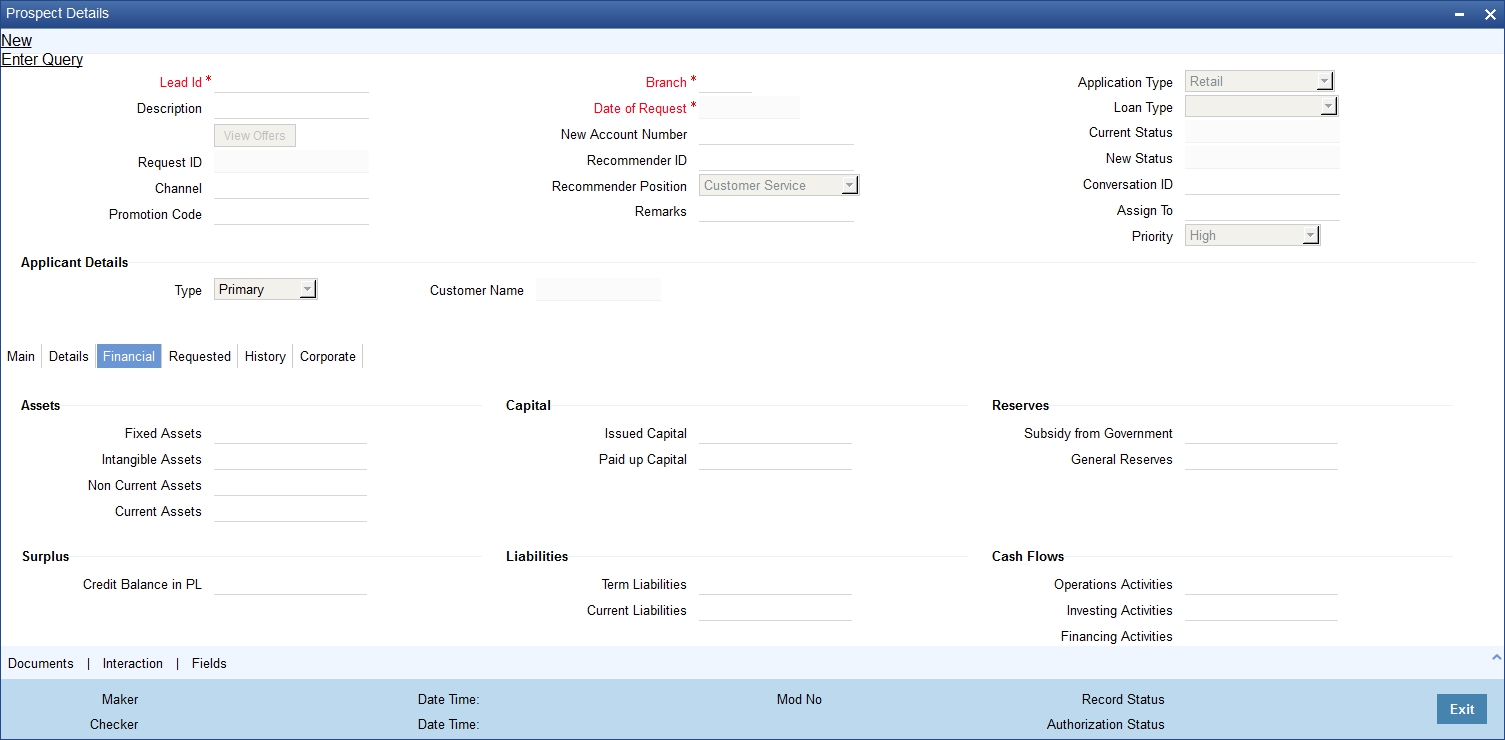

2.2.4 Financial Tab

You can capture the details related to the finance in the ‘Financial’ tab.

Income Details

Income Type

Select the income type from the adjoining option list.

Frequency

Select the frequency of the income of the applicant.

Currency

Select the currency of the income from the adjoining option list.

Amount

Specify the income amount.

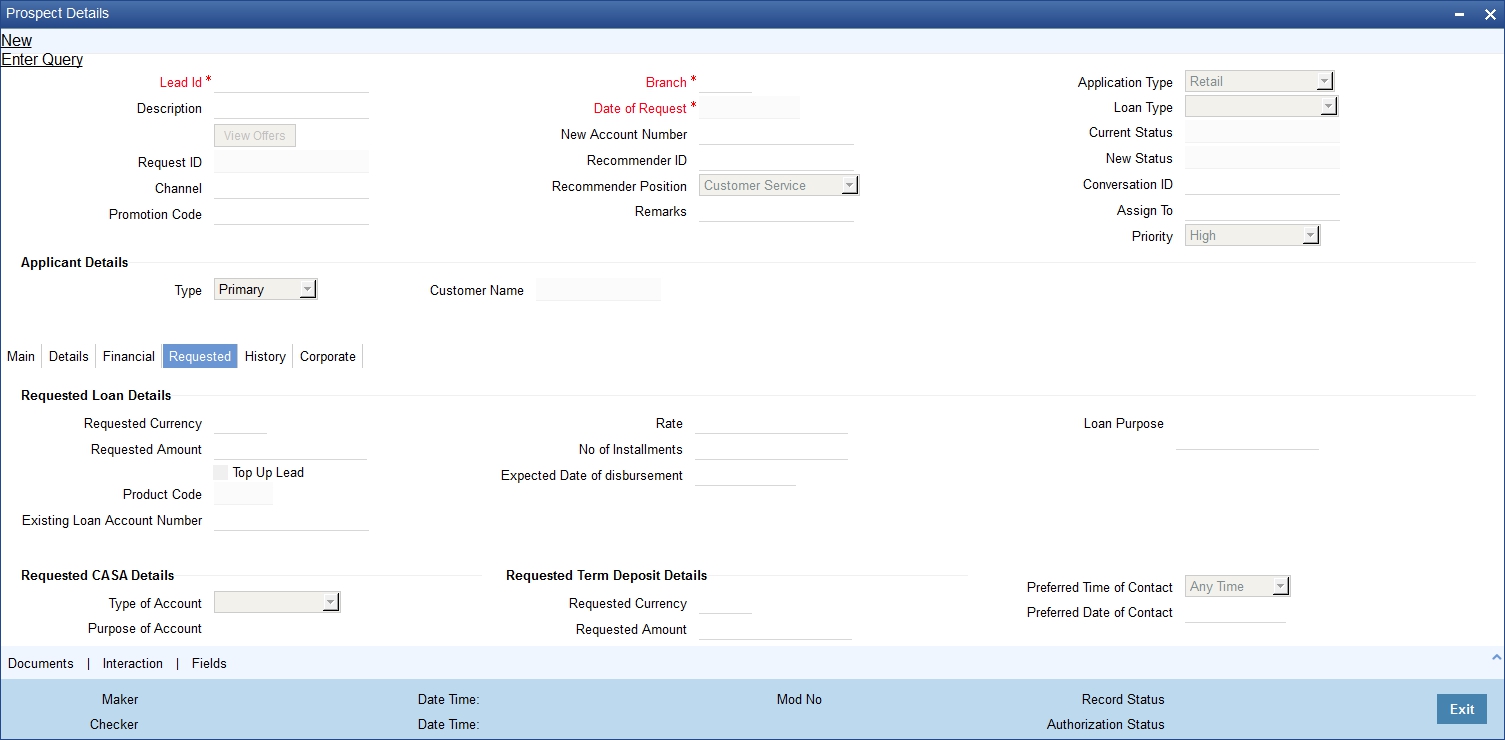

2.2.5 Requested Tab

You can capture the details related to the requested CASA in ‘Requested’ tab.

You can capture the following details here:

Requested CASA Details

Note

This section is applicable only for CASA Lead origination.

Type of Account

The system displays the type of account.

Purpose of Account

The system displays the purpose of the account.

Overdraft Limit Required

Check this box if overdraft limit is required.

If the loan type of CASA is ‘Cash Credit’ or ‘Overdraft’, then the following fields are enabled:

Requested Currency

Select the requested currency from the adjoining option list.

Requested Amount

Specify the requested amount.

Loan Purpose

Specify the purpose of the loan.

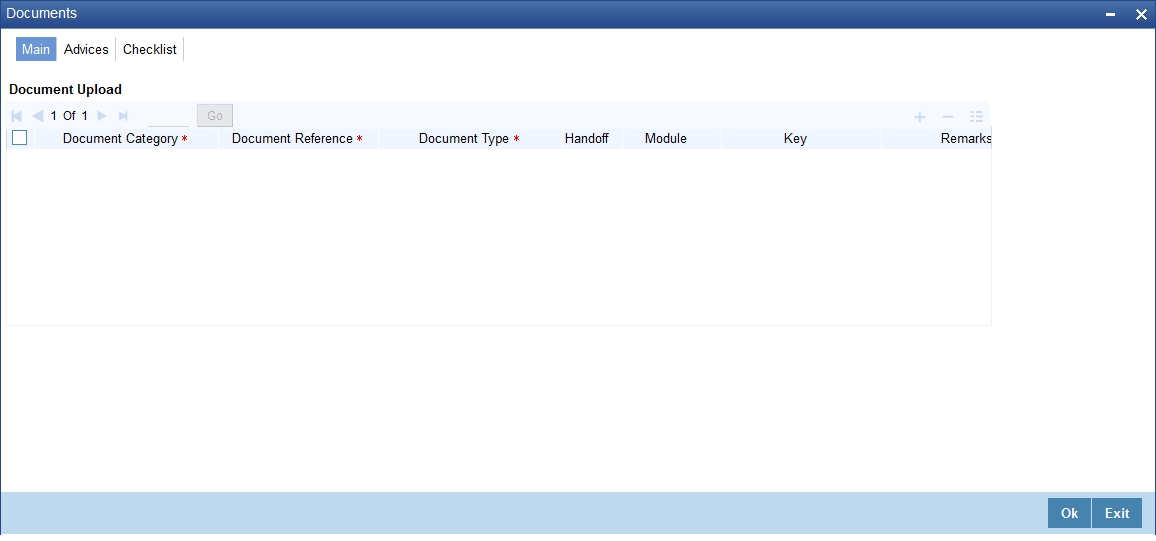

2.2.6 Document Details

Click on ‘Documents’ link to invoke the Documents screen.You can upload the required documents from the external system.

Document Category

Select the document category from the adjoining option list.

Document Reference

Specify the document reference.

Document Type

Select the type of document from the adjoining option list.

Remarks

Specify remarks, if any.

Ratio Upload

Check this box to enable ratio upload.

Upload

Click on ‘Upload’ button to upload the document.

View

Click on ‘View’ button to view the uploaded document.

The document upload from the external system is allowed only when:

- the customer submits the account opening request from the external system

- the status in the Prospect Details screen is ‘Additional Documents Required’.

Note

The documents uploaded by the customer through the external system is stored in the Document Management System with a document reference number.

Status Related Process and Validation

The details of conditional listing of statuses required based on ‘Application Type’ and ‘Current Status’ combination in ‘Lead Maintenance’ screen are listed in the below table:

Application Type |

Process Code |

Current Status |

New Status Available |

New Status Selected |

CASA |

LEAD |

New (Default Status for a new record) |

Follow Up Rejected |

Follow Up Rejected |

|

|

|||

|

|

Follow Up |

Under Process Rejected |

Under Process Rejected |

|

|

|||

|

|

Under Process |

Additional Doc Required Account Opening in Progress Rejected |

Additional Doc Required |

|

|

|

|

Account Opening in Progress Rejected |

|

|

|||

|

|

Additional Doc Required |

Under Process Rejected |

Under Process Rejected |

|

|

|||

|

|

Account Opening in Progress (Further process is done manually) |

Converted Rejected |

Converted Rejected |

|

|

|||

|

|

Account Opening in Progress (Further process is done through origination) |

- |

Origination in Progress (Automatic) This status gets updated automatically once the lead ID is linked with Origination reference number. |

|

|

Origination in Progress |

- |

Converted (Automatic) Once the account is successfully opened in origination this status gets updated automatically |

|

|

Converted Rejected |

- - |

- - |

|

|

- The default ‘Current Status’ for a new lead record will be ‘New’. In the ‘New Status’ field, the system lists the status based on the ‘Application type’, ‘Process Code’ selected and ‘Current Status’ of the record. The system enables you to proceed only when the new status you selected is applicable with respect to the current status. Else, the system displays the error message as “The status XXXXX cannot be chosen when the current status is XXXXX”.

- The system communicates the status along with the reason code to respective channels for each status change. When the status is updated as ‘Rejected’ or ‘Converted’, you cannot amend the lead record.

- The status ‘Converted’ and the field ‘New Account

Number’ are updated in lead record as listed below:

- If the account is created through origination flow (BPMN flow). then the system updates the lead record status as ‘Origination in Progress’. Then the lead ID is linked with the origination application reference number. On further flow when the account is created The system updates the ‘New Account Number’ in the Lead Maintenance screen with the newly created account number and changes the status as ‘Converted’.

- Alternatively, you can manually update the status as ‘Converted’. While updating the status as ‘Converted’ you must update the newly created account number also. Else, the system will displays an error message as "New Account Number to be entered".

- If the process flow is terminated for any reason, then the system updates the lead status as ‘Rejected’.

- You can link the lead ID with origination only when the current status of the lead record is ‘Account Opening in Progress’. The ‘Lead ID’ field in the origination screen will display a list of lead records which has the status as ‘Account Opening in Progress’.

2.3 Lead Maintenance Fields Validations

This section contains the following topics:

- Section 2.3.1, "Processing Lead Maintenance Fields"

- Section 2.3.2, "Validating Lead Maintenance Fields"

- Section 2.3.3, "Processing Lead Requests"

- Section 2.3.4, "Lead Workflow Chart"

2.3.1 Processing Lead Maintenance Fields

The following are the steps involved to create an account using ‘Lead Maintenance screen. This section also briefs you on the validations related to few fields.

- Documents uploaded in external channels are stored in Document Management System and a reference number is created in system using which you can view the uploaded documents.

- Once the field level requirements are maintained the status definition needs to be maintained for lead management. The following features available in the system facilitate the status definition maintenance for lead management:

- A process code ‘LEAD’ maintained is maintained in the ‘Process Code Maintenance’ screen.

- Status definition is maintained based on the ‘Application Type’

and ‘Process Code’ combination, maintained in Customer Maintenance

and Lead Maintenance screens respectively. The system displays the following

values for selection:

- New

- Follow up

- Under Process

- Additional Doc Required

- Account Opening in Progress

- Converted

- Rejected

- Origination in Progress

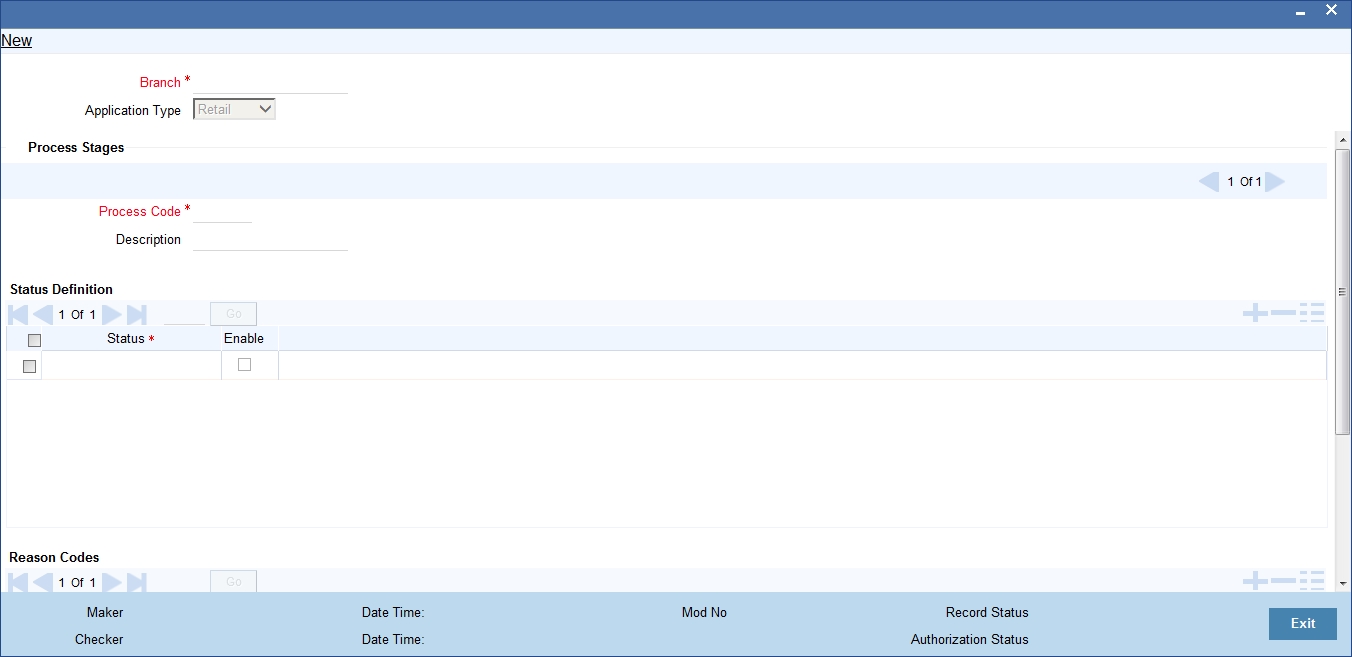

You can link different reason codes to status definition in the ‘Status Maintenance Screen’. Reason codes are linked based on the ‘Application Type’, ‘Process Code’ and ‘Status Definition’ combination. You can invoke this screen by typing ‘ORDSTRMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can maintain the following details:

Branch

The system the current branch code here.

Application Type

Select the application type you need to link to the status definition, from the adjoining drop-down list. The list displays the following values:

- CASA

- Retail

When the Application Type is ‘CASA’ and Process Code is ‘LEAD’, then the ‘Status Definition’ field displays the status values maintained in the system; however you can specify the values additional to the ones displayed. These values are stored in the database.

Process Stages

Process Code

Specify a valid process code you need to link to the status definition. The adjoining option list displays all valid process codes for the application type selected. Select the appropriate one.

Description

System displays the description of the selected process code.

Status Definition

Status Definition

Specify a valid status definition you need to link. Also, the adjoining option list displays all valid status definition for the process codes selected. You can select the appropriate one.

Enable

Check this box to enable status usage for the application type or process code.

Reason Codes

Reason Code

Specify a valid reason code you need to link. The adjoining option list displays all valid error codes maintained as ‘I’ at ‘Error Message Maintenance’ level are displayed here. Select the appropriate one.

You can link multiple reason codes to a status definition in this screen. However, it is mandatory to link at least a single reason code. This linking is extended to origination process codes also

Description

System displays the description of the selected reason code.

Enable

Check this box to enable status usage for the application type or process code.

Interaction

- Interaction between branch user and channel user is established using the interaction module in ‘Lead Maintenance’ screen and the Conversation ID is referred to as Interaction ID. Interaction ID for a prospect is branch walk-in customer ID. If a branch walk-in customer is not available, then the system displays an error message as "Walk-in Customer not Available for the Branch".

The ‘Reason Code’ and ‘Remarks’ details are sent to the channel, along with the status communication for a particular stage.

- Before submitting the lead request, you can initiate the interaction from channels. In such scenario interaction will be assigned to ‘Help Desk’ initially and then at later stage when customer chooses the branch, the system automatically changes the assignee to ‘All Roles’ for the customer chosen branch. The system defaults the User/Role field of the interaction as ‘Role’.

Note

Channel will send the Conversation ID along with the Request ID/Lead ID to the system, if interaction was initiated before the lead request is submitted.

- If the interaction is not started in channels even after the lead request is submitted, the branch user can initiate the interaction at any stage using the ‘Conversation’ button. The generated Conversation ID along with the Request ID/Lead ID is sent to respective channels for further conversation. However, the ‘Conversation ID’ once updated cannot be amended.

2.3.2 Validating Lead Maintenance Fields

The system validates if;

- For the application type CASA, the default current status for a new record is ‘New’.

- Based on the application type and current status are the ‘New Status’ values listed.

- Based on the new status value selected, are the reason codes linked to that status displayed in reason code field.

- If employment type is ‘Self Employed’ or ‘Other’, then are the fields under ‘Business Details’ header enabled. For all the other options, fields under ‘Business Details’ must be disabled.

- For ‘Part time’, ‘Full time’ and ‘Contract Based’ employment type, are the following fields enabled. For any other employment type they are disabled.

- Occupation

- Designation

- Employee id

- The fields under ‘Requested CASA Details’ must be enabled only when ‘Application Type’ is CASA.

- Overdraft Limit Required field must be enabled only when ‘Type of Account’ is selected as ‘Current Account’.

2.3.3 Processing Lead Requests

You can receive the lead request from customer or prospects. The possible scenarios and the behavior of CIF ID for each scenario are explained below.

Scenario 1:

A prospect not holding any relationship with the bank raises a request from channels.

- In Applicant Details section of Lead Maintenance screen, ‘Existing’ check box will be unchecked.

- A new CIF ID is allocated to the prospect and is displayed in Customer Number field of Applicant Details section in Lead Maintenance screen.

- Once the lead is converted and if the new account is opened through BPMN route then the allocated CIF ID can be used.

- Once the lead is converted and if the new account is opened through manual CIF creation, then while opening an account opening, the allocated CIF ID needs to be released once the status of the lead is updated as converted.

Scenario 2:

An existing customer with FCDB login credentials can apply for a new account by logging into net banking.

- In Applicant Details section of Lead Maintenance screen, ‘Existing’ check box will be checked by default.

- Customer ID provided by the customer in channels is validated in channels and is displayed in Customer Number field of Applicant Details section in Lead Maintenance screen.

Scenario 3:

An existing customer without FCDB login credentials can apply for a new account by providing the existing relationship details and FCPB does not validate existing data.

- In Applicant Details section of Lead Maintenance screen, ‘Existing’ check box will be checked by default.

- Walk in Customer ID is computed by default in Customer Number field of Applicant Details section in Lead Maintenance screen.

- When the branch employee amends the lead record of walk-in customer ID, the system will display an error as “Invalid CIF, cannot amend a lead record as existing customer and customer ID is walk in ID".

Scenario 4:

An existing customer applies for an account as a prospect from FCDB without providing any existing relationship details. This procedure is similar to scenario 1.

Note

When the current status of the lead record changes to ‘Rejected’, then the CIF IDs blocked for the Scenarios 1 and 4 are released automatically by the system, so that the blocked CIF IDs can be re used.

Once the Lead request is approved and converted. customer account is created through either of these;

- BPMN - Refer "Example 2.4" on page 19

- Opening an account through normal process

2.3.3.1 Opening an Account through Normal Process

The account opening through normal process comprises of the following stages

- CASA lead request submitted from channels

- Receive and account opening form and other documents

- Store documents

- Seek approval for missing documents / details

- Modify and resubmit the application

- Input details of current account

- Prospect / customer details

- Modify details of current account

- Know Your Customer checks

- Block customer in the system on negative Status of KYC check

- Notify prospect / customer on negative status of KYC checks

- Create / Modify customer details in the system

- Create Customer and Customer Account, if the request is from prospect and Create Customer Account, if the request is from existing customer

- Check available balance

- Generate cheque book in the system

- Issue Debit Card

- Generate welcome / thanks letter in the system

- Notify the customer/prospect about the successful account opening with details

- Deliver account kit to customer

- Store documents

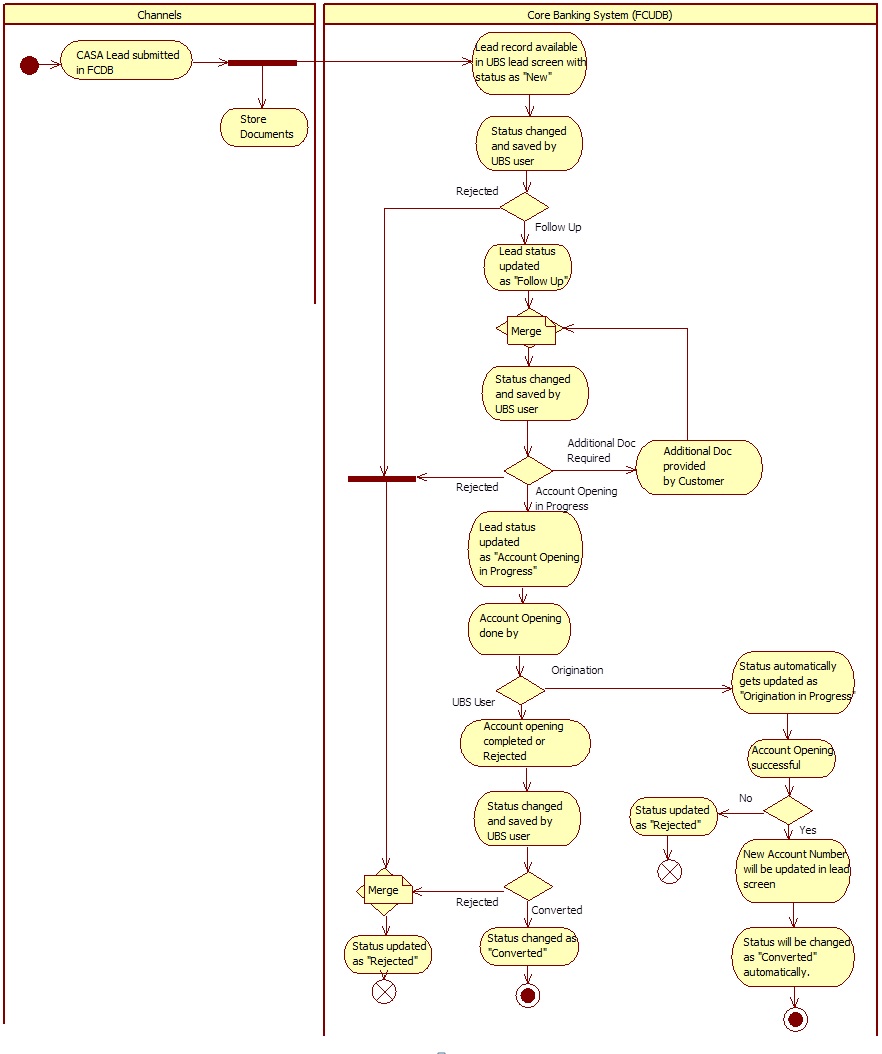

2.3.4 Lead Workflow Chart

The below flow chart provides graphical flow of the process followed for lead requests:

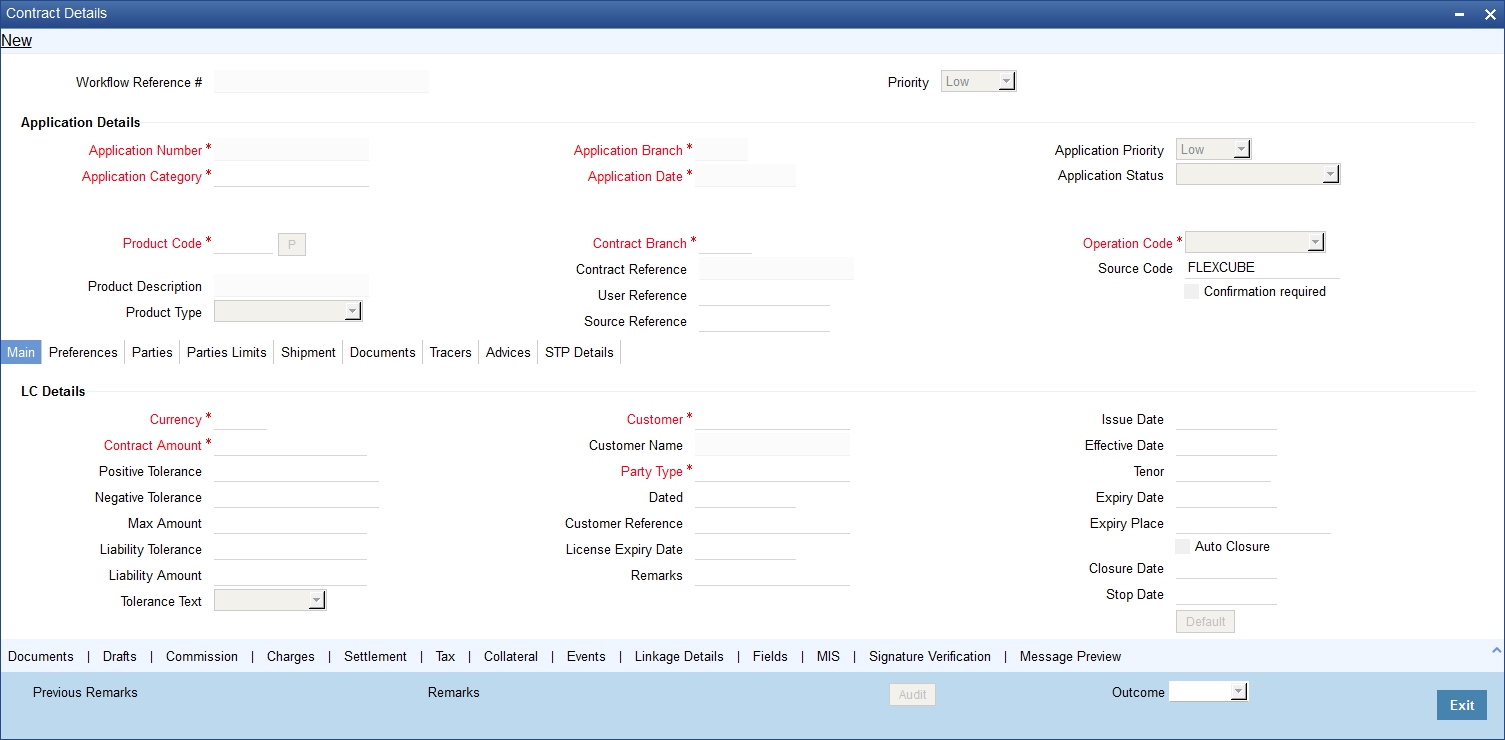

2.4 Stages for Request Received through Branch (BPMN)

In Oracle FLEXCUBE, the process for opening a current account is governed by several user roles created to perform different tasks. These tasks are categorized to different stages. Stages fo opening a current account are almost similar, with few exceptions. At every stage, the users (with requisite rights) need to fetch the relevant transactions from their task lists and act upon them. Similarly, at different times, the system will make calls to certain web services to process the transaction.

This section contains the following topics:

2.4.1 Stages

The account opening process through BPMN comprises of the following stages:

- Receive and account opening form and other documents

- Seek approval for missing documents / details

- Store documents

- Input details of current account

- (Sub process )Know Your Customer checks

- Block customer in the system on negative Status of KYC check

- Notify prospect / customer on negative status of KYC checks

- Create / Modify customer details in the system

- Create account in the system

- Check available balance

- Generate cheque book in the system

- Issue Debit Card

- Generate welcome / thanks letter in the system

- Notify the customer/prospect about the successful account opening with details

- Deliver account kit to customer

- Store document reference in the system

You can open a current account even without opting for the ATM facility. Current account opening process will support for capturing the branch and account details of the applicant.

Only users who have procured the relevant access rights can perform activities under a stage.

2.4.2 BPMN Flow Diagram

Refer Current Account Flow Process Flow for the flow diagram.

2.5 Receive and Account Opening Form and Documents

Users belonging to the user role ‘CCSEROLE’ (Corporate Customer Service Executive) can perform these activities.

This section contains the following topics:

- Section 2.5.1, "Receive and Verify"

- Section 2.5.2, "Capturing Customer Details"

- Section 2.5.3, "Main Tab"

- Section 2.5.4, "Personal Tab"

- Section 2.5.5, "Corporate Tab"

- Section 2.5.6, "Directors Tab"

- Section 2.5.7, "Bank Details Tab"

- Section 2.5.8, "Domestic Tab"

- Section 2.5.9, "Professional Tab"

- Section 2.5.10, "Specifying MIS Details"

- Section 2.5.11, "Specifying User Defined Fields"

- Section 2.5.12, "Capturing Document Details"

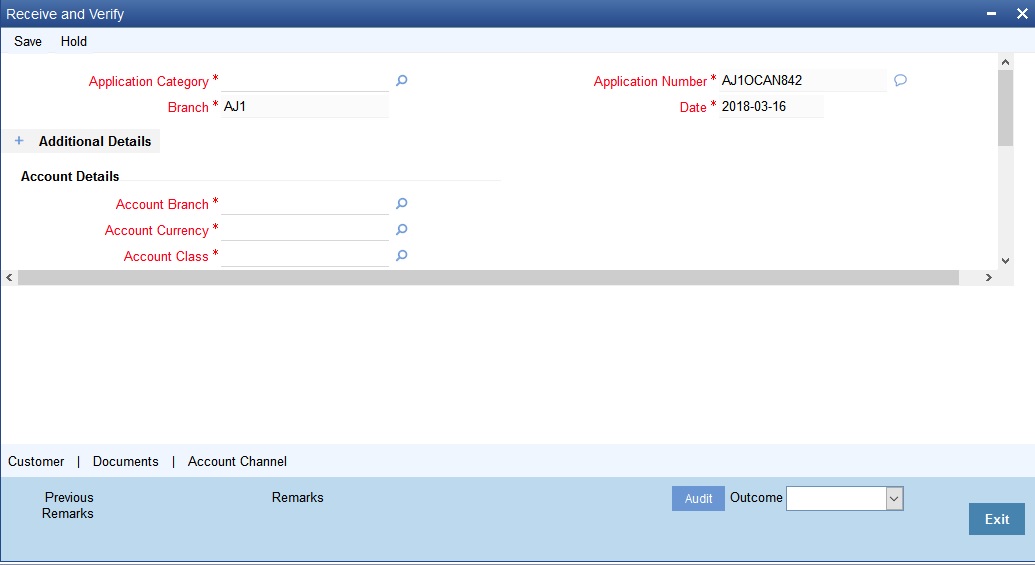

2.5.1 Receive and Verify

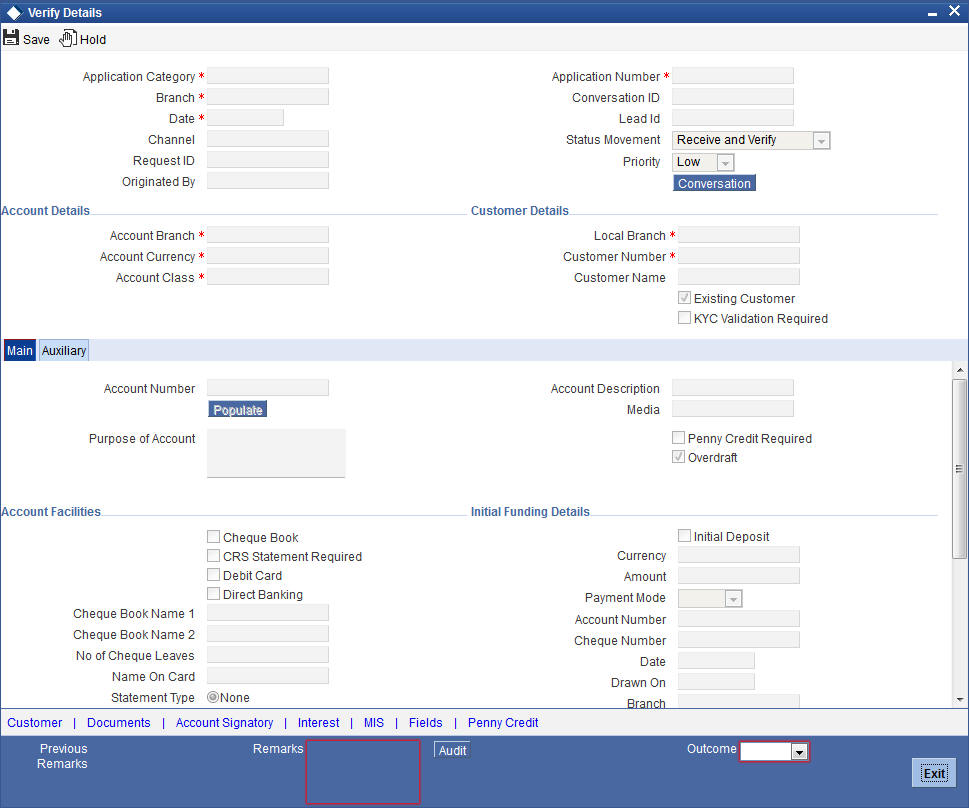

The bank receives the required documents from the customer for opening a current account. If you have the required access rights, you can capture basic account details, customer details for each of the applicant and attach multiple supporting documents using ‘Receive and Verify’ screen. To invoke this screen, type ‘STDCA001’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button. The screen is displayed below:

Specify the following basic details in this screen:

Application Category

Specify the application category from the adjoining option list.

Application Number

System generates the application number at the account opening stage. This number remains unique till the last stage.

Branch

System displays the logged in branch code.

Date

The date of the applicaton.

Additional Details

Channel

The source through which the application is raised.

Request ID

The ID of the application request.

Originated By

The origin of the request.

Lead ID

Specify a valid Lead ID for which you need to create the account. The adjoining option list displays a list of valid lead ID. Select the appropriate one.

Status

System displays the status of the application.

Conversation ID

The conversation ID.

Priority

Select the priority for the creating the current account from the adjoining drop-down list. This list displays the following options:

- Low

- Medium

- High

The priority selected here is displayed in the Task List screens for all the further stages of the account creation. You can set the preference to list the task according to the priority. For instance, if you prefer to list the tasks in the order of High to Low priority, click the ‘Priority’ column in the Task List screen. Second attempt of the same would list in the vice-versa order.

Account Details

Capture the basic account details of the customer here:

Account Branch

The current logged in branch is displayed here.

Account Currency

Specify the currency of the customer account. You can also select the appropriate currency from the adjoining option list. The list displays all the valid currencies maintained in the system.

Special Account Number Generation

Check this box if you want to generate special account number.

Account Class

Specify the account class to be used by the account. You can also select the appropriate account class from the adjoining option list. The list displays all the valid current account classes which are maintained in the system.

Customer Details

Existing Customer

Check this option, if the selected customer is an existing customer.

Customer Name

The name of the selected customer is displayed here.

Local Branch

Specify the applicant’s home branch from the adjoining option list.

Customer Number

Specify a valid customer number. You can also select the appropriate customer number from the adjoining option list. The list displays all valid customers maintained in the system.

Special Customer Number Generation

Check this box if you want to generate special customer number.

Note

If customer is not an existing customer, on pressing ‘Populate’ button system will create a new customer number.

System displays ‘Local Branch’ and ‘Customer Number’ when you click on the ‘Populate’ button.

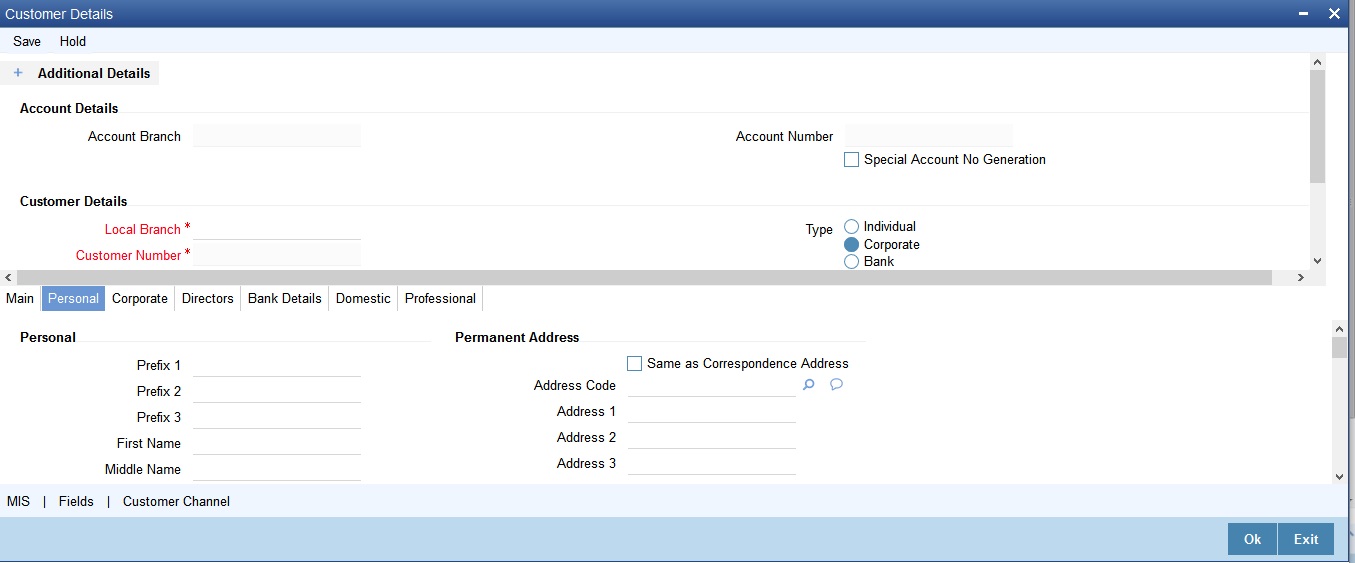

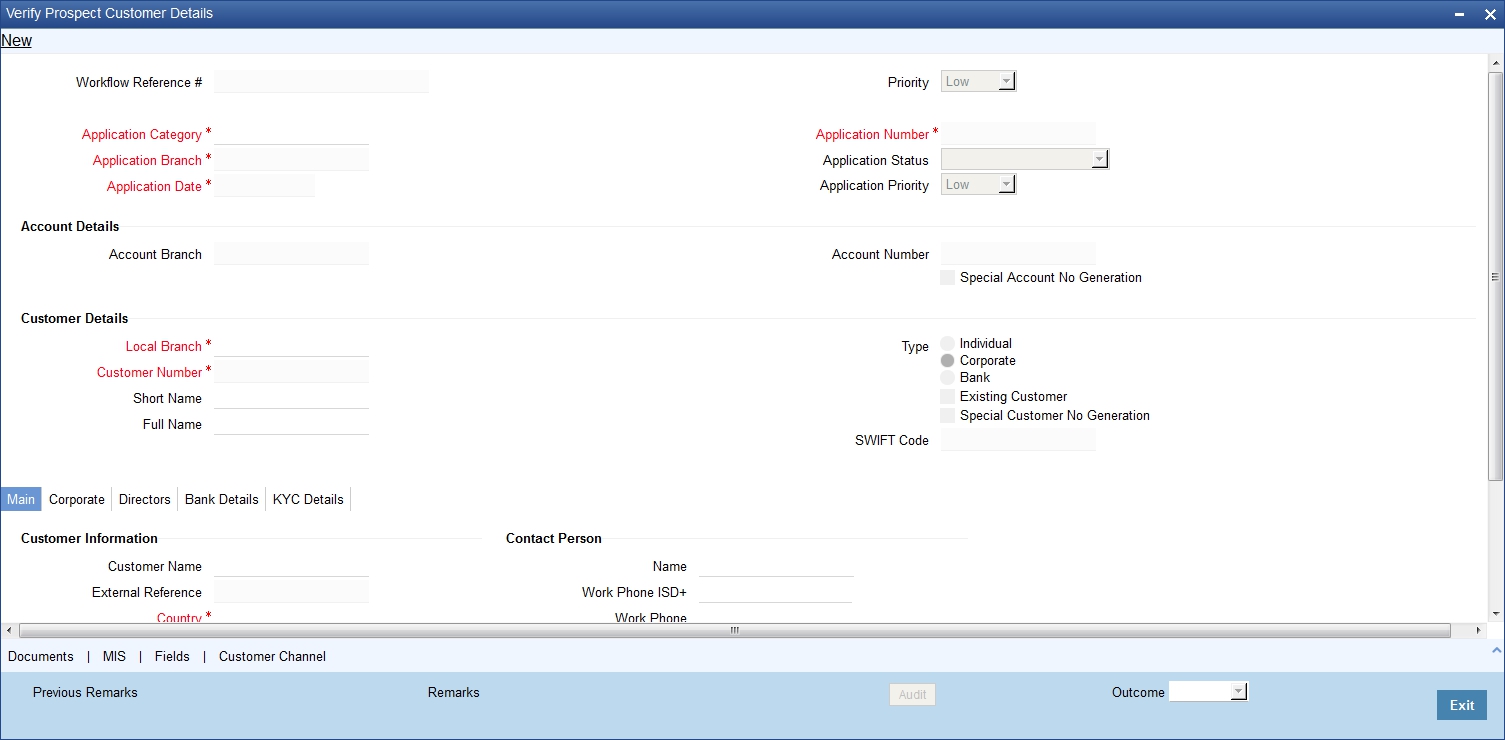

2.5.2 Capturing Customer Details

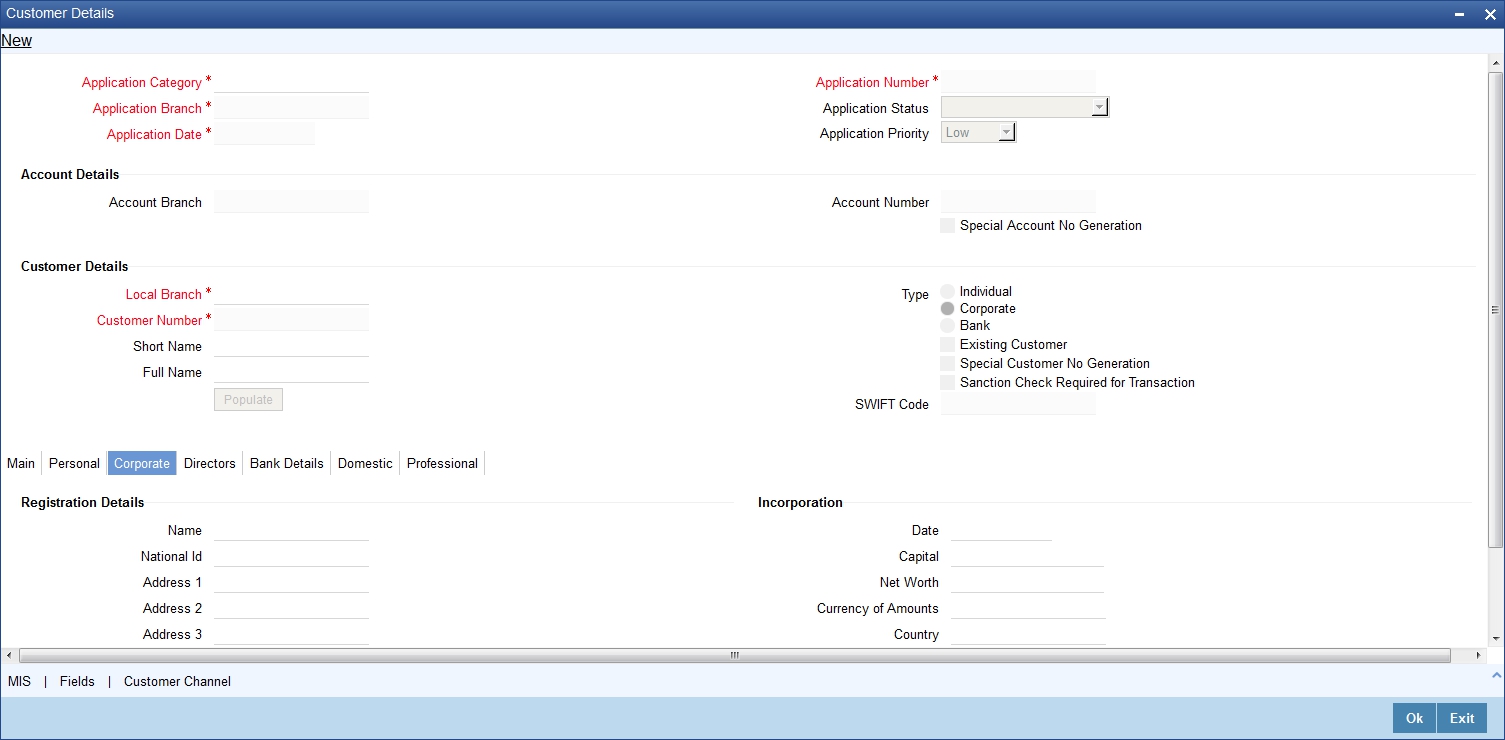

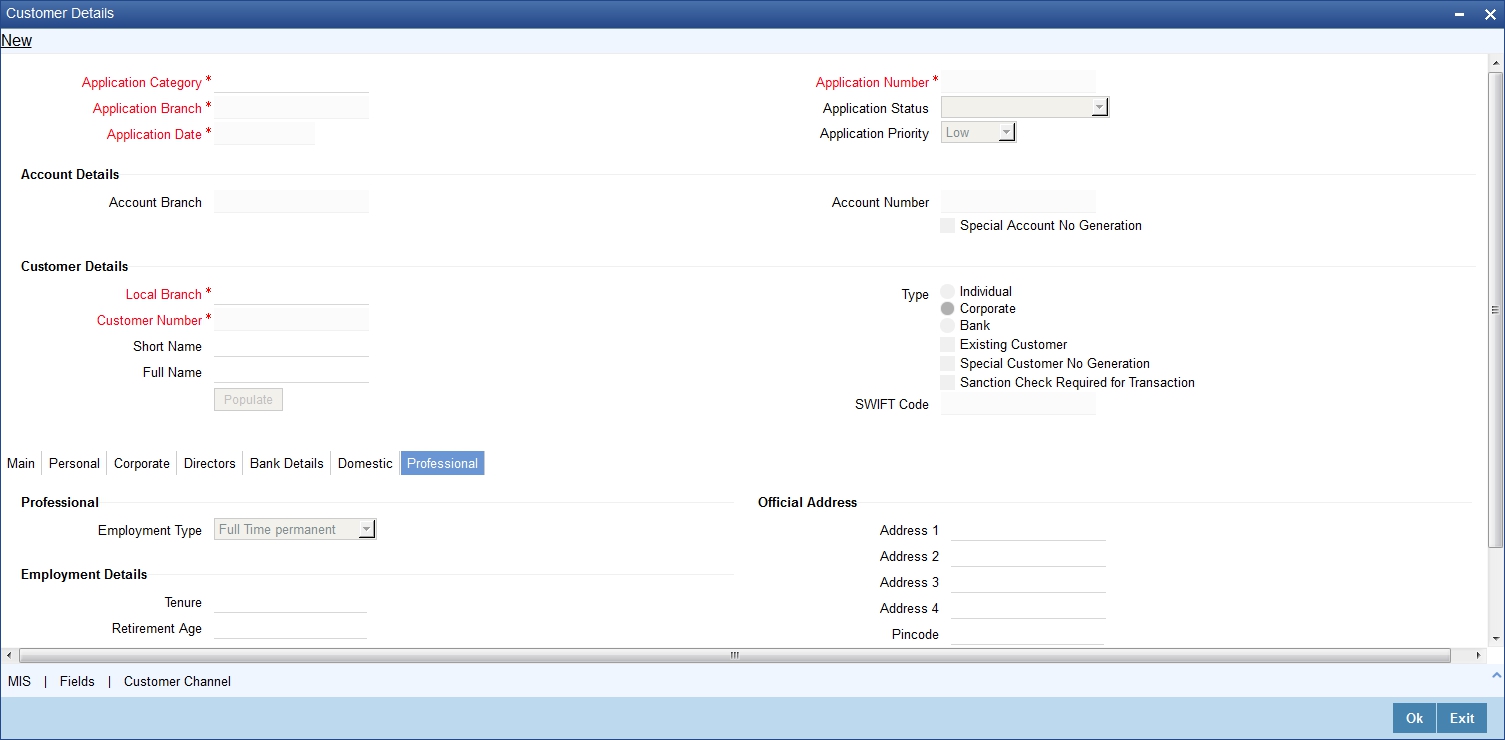

Click ‘Customer’ button to capture customer details. The following screen is displayed:

Here you can maintain the following details:

System displays the following details:

- Application Category

- Application Number

- Application Branch

- Application Status

- Application Date

- Application Priority

Customer Details

Local Branch

System displays the applicant’s home branch.

Customer Number

System displays the customer number here.

Full Name

Specify the full name of the customer.

Short Name

Specify the short name of the customer.

Type

Select the customer type as one of the following:

- Individual

- Corporate

- Bank

Existing Customer

If this box is checked in the ‘Receive and ’ screen, then the same is displayed here.

SWIFT Code

System displays the swift code in case the customer is a bank.

2.5.3 Main Tab

You can maintain the following details here:

Customer Information

In this section, maintain the following basic customer details:

Customer Name

Specify the full name of the customer.

External Reference

System displays the external reference number if the customers data is maintained in the another system,

Country

Specify the country in which the customer resides.

Nationality

Specify the nationality of the customer.

Language

As part of maintaining customer accounts and transacting on behalf of your customer, you will need to send periodic updates to your customers in the form of advices, statement of accounts and so on.

Indicate the language in which your customer wants the statements and advices to be generated. The option list positioned next to the language field contains all the language codes maintained in the SMS module. Select the appropriate language.

Customer Category

Specify the category in which the customer belongs to. Each customer that you maintain can be categorized under any one of the categories that you have maintained in the system. Select from the option list and indicate the category under which the particular customer is to be categorized.

Location

The customer’s location.

Media

The mode of communication to be used.

Communication Mode

Select the mode of communication you need from the options. The following options are available for selection.

- Mobile – Select if you need mobile as the communication mode.

- Email – Select if you need Email as the communication mode.

Contact Person Details

In this section, indicate the contact person’s details of the current account being created. Specify the following details:

Name

Specify the name of the contact person.

Work Phone ISD+

Specify a valid international dialling code for the work telephone number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Work Phone

Specify the work telephone number of the customer.

Home Phone ISD+

Specify a valid international dialling code for the home telephone number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Home Phone

Specify the home telephone number of the customer.

Mobile ISD Code+

Specify the international dialling code for the mobile number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Mobile Number

Specify the mobile number of the corresponding customer.

Specify the e-mail id of the contact person.

Preferred Date of Contact

Specify the preferred date for contacting the customer. You can also select the date from the adjoining calendar icon.

Preferred Time of Contact

Select the preferred time for contacting the customer on the preferred date of contact, from the adjoining drop-down list. This list displays the following time slots in 24hrs format:

- Any time

- 1 hour combination of timings starting from 12am – 1am to 23pm – 12am.

Relationship Manager

ID

The relationship manager ID.

Name

The name of the relationship manager.

Statuses

Private Customer

Check this box to indicate that the customer is a private type of customer.

Eligible for AR-AP Tracking

Check this box to indicate that account receivable and payable process is to be enabled for the corresponding customer.

Permanent US Resident Status

Check this box to indicate that the corresponding director is a permanent US resident.

Visited US in last 3 years?

Check this box to indicate that the beneficial owner has visited US in the last three years.

CRS Customer Type

Select the CRS customer type for which the maintenance is done from the drop-down list. The list displays the following options:

- Individual

- Financial Entity

- Active Non-Financial Entity

- Passive Non-Financial Entity

Address of Correspondence

Address Code

Select the address code from the option list.

Address 1-4

The address is auto populated based on the address code you select. You can also enter it manually.

Pin Code

The pincode is auto populated based on the address code you select. You can also enter it manually

Country

The country is auto populated based on the address code you select. You can also enter it manually

Send Correspondence through Email

The system defaults the value maintained for ‘Send by Email’ check box at ‘Customer Address Maintenance’ level.

The customer address data is created along with customer opening.

Sanction Check Details

Requested Date

The system displays the date when the sanction check request is send.

Response Date

The system displays the date when the response is updated from the external system.

Sanction Check Status

The system displays the sanction check response status.

Combined Statement Plan

Auto Generated Statement Plan

Check this box to enable automatic generation of statement.

Frequency

Select the frequency for combined statement generation. It can be:

- Weekly

- Monthly

- Yearly

Statement Day

Select the day on which the statement is to be sent to the customer.

2.5.4 Personal Tab

Click ‘Personal’ tab to maintain personal details.:

You can maintain personal details here:

Tax Identification

Tax ID

Specify the tax identification number (TIN) of the customer.

Country of Issue

Specify the country which has issued the tax ID for the customer. Alternatively, you can select the country from the option list.

Additional Tax ID Details

The system displays the following tax details:

- Tax ID

- Country of Issue

Personal

Prefix1-3

Specify prefix for the customer name

First

Specify first name of the customer.

Middle

Specify middle name of the customer.

Last

Specify last name of the customer.

Work Phone

Specify a valid office phone number of the customer.

Work Phone ISD+

Specify a valid international dialling code for the work telephone number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Home Phone ISD+

Specify a valid international dialling code for the home telephone number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Home Phone

Specify a valid home phone number of the customer.

Specify a valid e-mail ID of the customer for correspondence.

Mobile Number

Specify a valid mobile number of the customer.

Fax Number

The customer’s valid fax number.

Gender

Select a valid gender of the customer from the options. The following options are available for selection:

- Male

- Female

- Other

- Prefer Not to Disclose

Permanent address

You can specify the permanent address details here:

Same as Correspondence Address

Check this box if the permanent address is same as the correspondence address.

Address1-4

Specify the permanent address of the customer.

Pincode

Specify the pin code of the permanent address.

Country

The customer’s country name.

Passport Details

You can specify the passport details here:

Passport Number

Specify a valid passport number of the customer.

Issue Date

Specify the date on which the specified passport was issued from the adjoining Calendar icon.

Expiry Date

Specify the expiry date of the specified passport from the adjoining Calendar icon.

Legal Guardian

You can specify the legal guardian details here:

Birth Place

The legal guardian’s birth place.

Birth Country

The legal guardian’s birth country.

Date of Birth

Specify date of birth of the legal Guardian

Nominee Minor

Check the box if the customer is a Minor.

Guardian

Specify the details of the legal guardian.

Submit Age Proof

Select the appropriate option if you want to submit documents for age proof.

Power of Attorney

Note

If the FATCA is enabled at the bank and the check box 'Power of Attorney' is checked here, then it is mandatory to specify the Power of Attorney information.

Power of Attorney

Check this box to indicate that the customer account is to be operated by the power of attorney holder.

Holder Name

The person who has been given the power of attorney.

Address

Specify the address of the power of attorney holder.

Country

Specify the country of the power of attorney holder.

Nationality

Specify the nationality of the power of attorney holder.

Telephone ISD Code +

Specify the international dialling code for the telephone number of the power of attorney holder. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Telephone Number

Specify the telephone number of the power of attorney holder.

Additional Details

Staff

Check this box if the customer is a staff.

2.5.5 Corporate Tab

Click ‘Corporate’ tab to maintain corporate details.

You can maintain corporate details here:

Registration Details

You can specify the registration details here:

Name

Specify the registration name of the organization.

Address Code

The address code,

Address 1-4

Specify the registration address of the organization.

Pin code

Specify the pin code of the registration address of the organization.

Country

Specify the country code of the registration address of the organization. The adjoining option list displays all valid country codes. select the appropriate one.

Incorporation

You can maintain the incorporation details here:

Date

Specify the date of incorporation from the adjoining Calendar icon.

Capital

Specify the capital amount of incorporation.

Net Worth

Specify the net worth of the organization.

Currency of Amounts

Specify the currency code of the amounts. The adjoining option list displays all valid currency codes. select the appropriate one.

Country

Specify the country code of incorporation. The adjoining option list displays all valid country codes. Select the appropriate one.

Additional Details

Type of Ownership

Specify a valid type of ownership of the customer for the specified organization.

National ID

Specify the national ID of the organization.

Description of Business

Provide description for the business, if any.

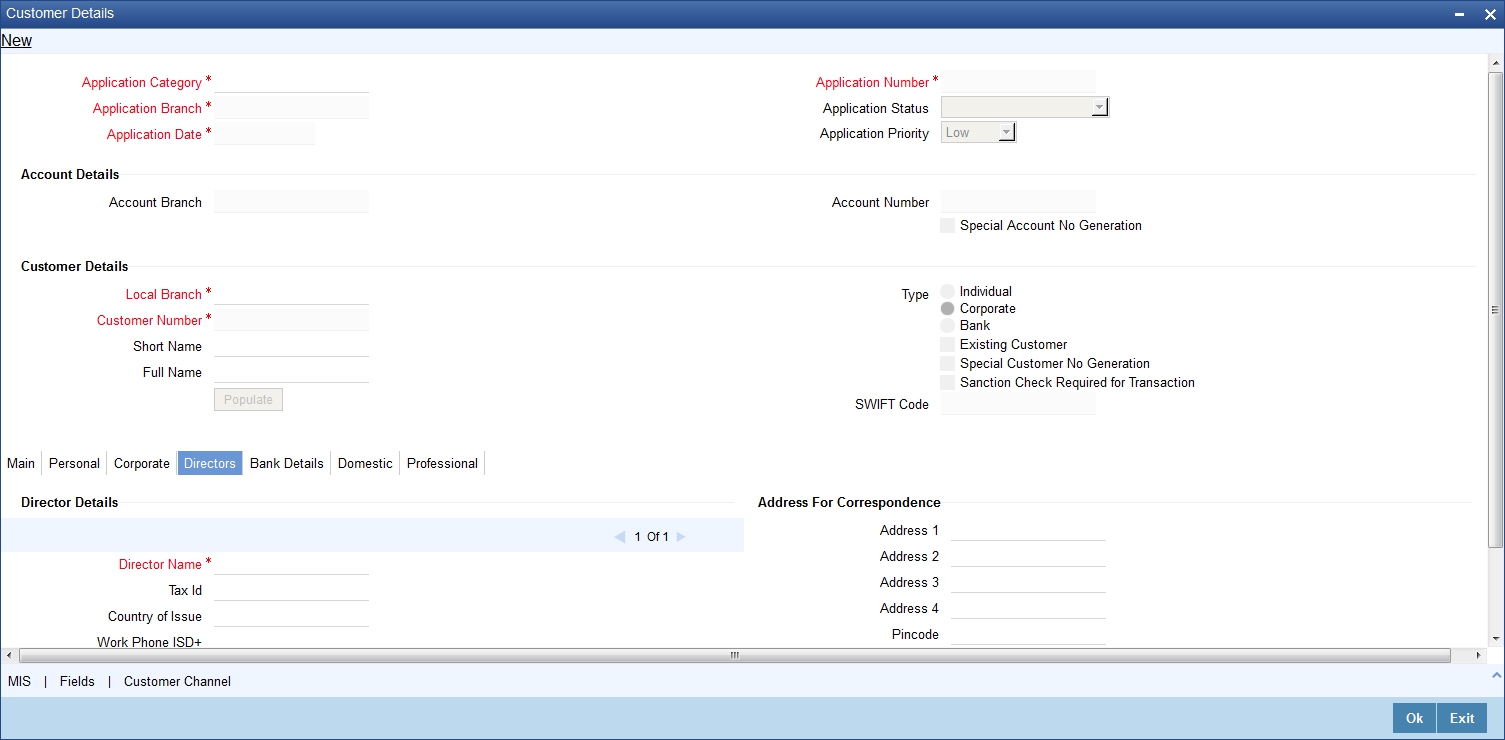

2.5.6 Directors Tab

Click ‘Directors’ tab to maintain directors details.

You can maintain the director details here:

Director Details

Director Name

Specify the name of the director.

Tax ID

Specify the tax identification number (TIN) of the director

Work Phone ISD+

Specify a valid international dialling code for the work telephone number of the director. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Work Phone

Specify the work telephone number of the director.

Home Phone ISD+

Specify a valid international dialling code for the home telephone number of the director. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Home Phone

Specify the home telephone number of the director.

Mobile Number

Specify the mobile number of the director.

Specify the E-mail of the director

Address For Correspondence

Address 1-4

Specify the address of correspondence of the director.

Pin Code

Specify the pin code of correspondence of the director.

Country

Specify the country code of the correspondence address. The adjoining option list displays all valid country codes. Select the appropriate one.

Permanent Address

Address 1-4

Specify the permanent address of the director.

Pin Code

Specify the pin code of the specified permanent address.

Country

Specify the country code of the specified permanent address. The adjoining option list displays all valid country codes. Select the appropriate one.

Other Details

Nationality

Specify the nationality of the director.

Permanent US Resident Status

Check this box if the director is a permanent resident of US.

Share Percentage

Specify the percentage of shares the director holds.

Date of Birth

Specify the date of birth of the director.

Birth Place

Specify the birth place of the director.

Birth Country

Specify the birth country of director.

Type of Ownership

Specify the type of ownership. Alternatively, you can select the ownership type from the option list. The list displays all valid options.

This field is mandatory if CRS customer type is Passive Non-Financial Entity.

Additional Tax Details

Tax ID

Specify the tax identification number (TIN) of the director.

Country of Issue

Select the country which has issued the TIN for the director.

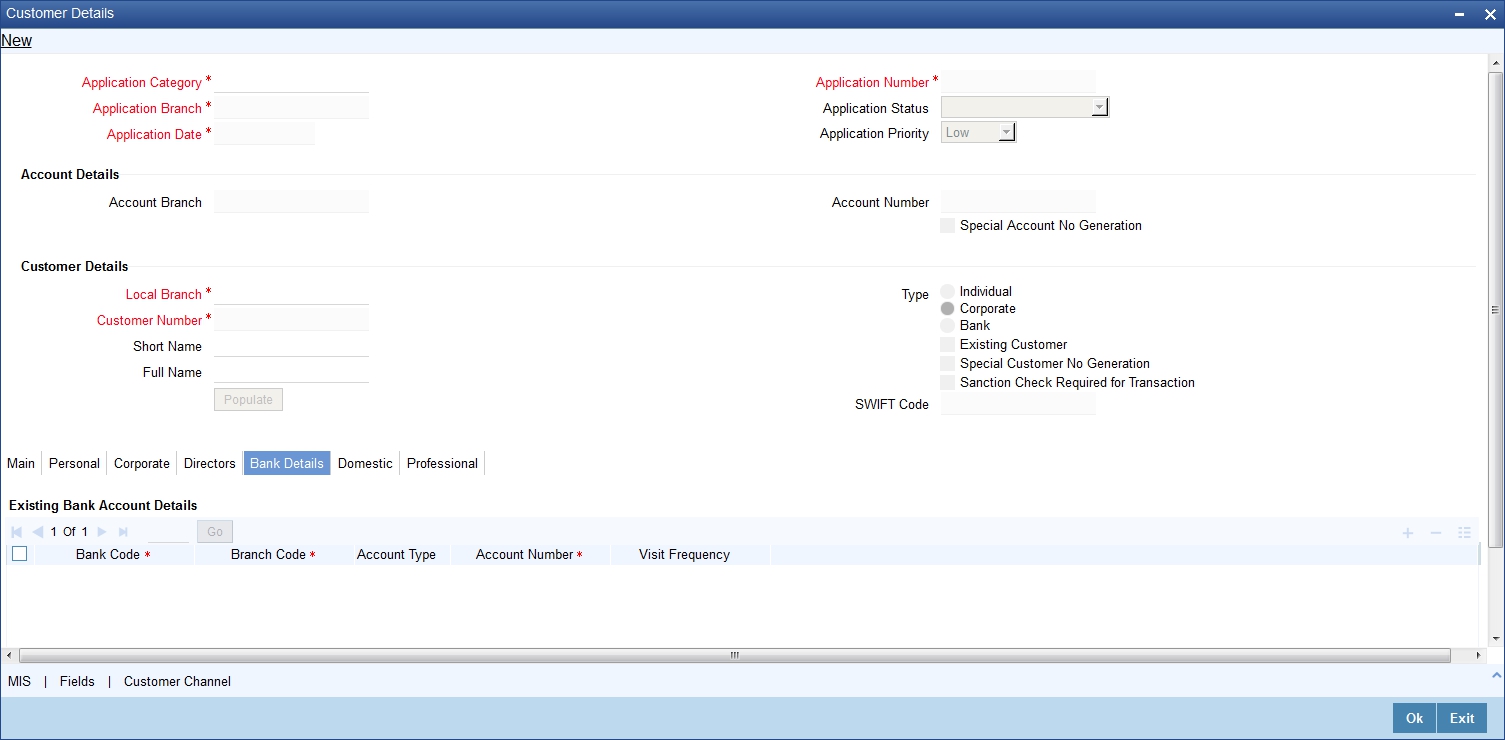

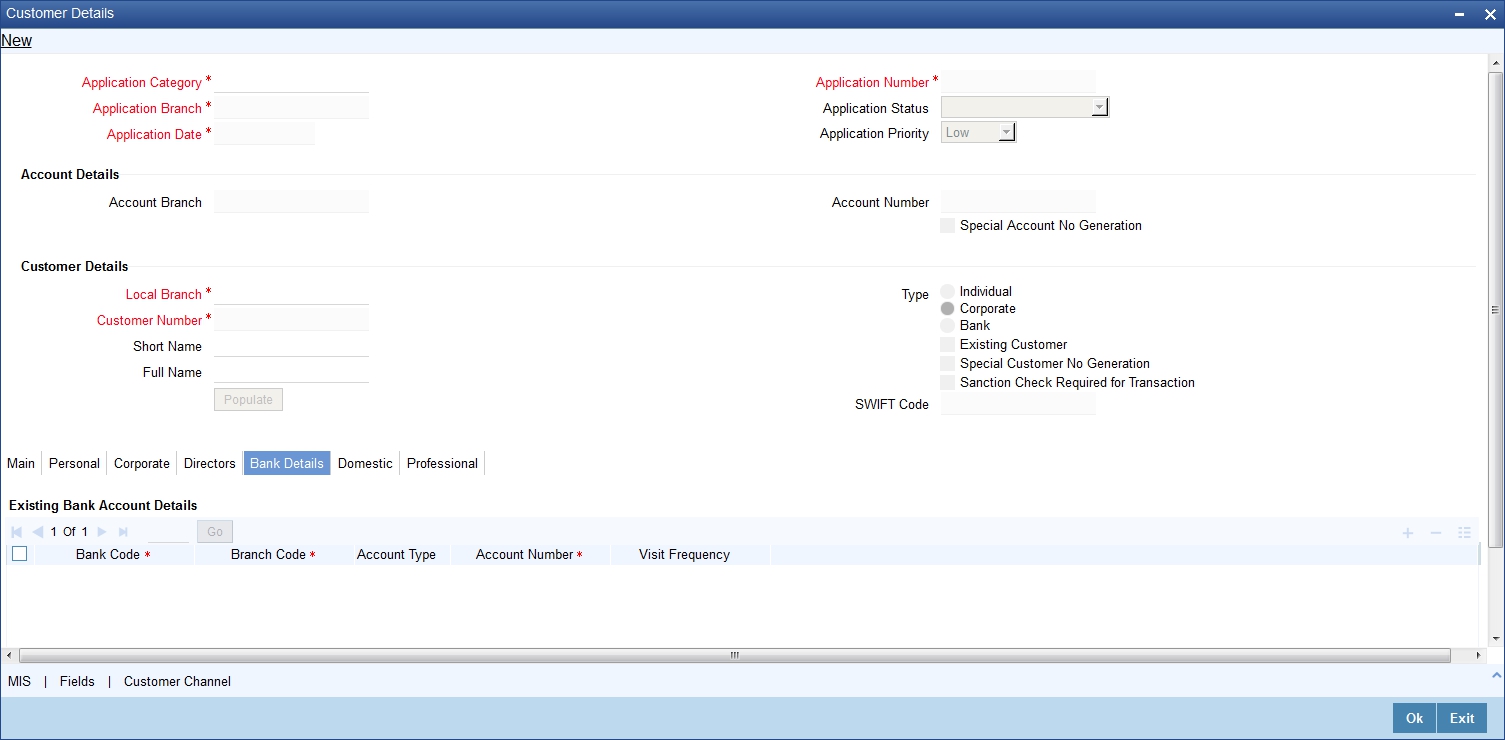

2.5.7 Bank Details Tab

To maintain the bank details, click ‘Bank Details’ tab. The following screen is displayed:

You can specify the existing bank account details here.

Bank Code

Specify the existing bank code.

Branch Code

Specify the existing branch code.

Account Type

Specify the account type from the adjoining drop-down list. Available options are:

- Nostro

- Misc Dr

- Misc Cr

- Savings Current

- Deposit

- Line

Account Number

Specify the existing account number

Visit Frequency

Specify how frequently the customer visits the bank.

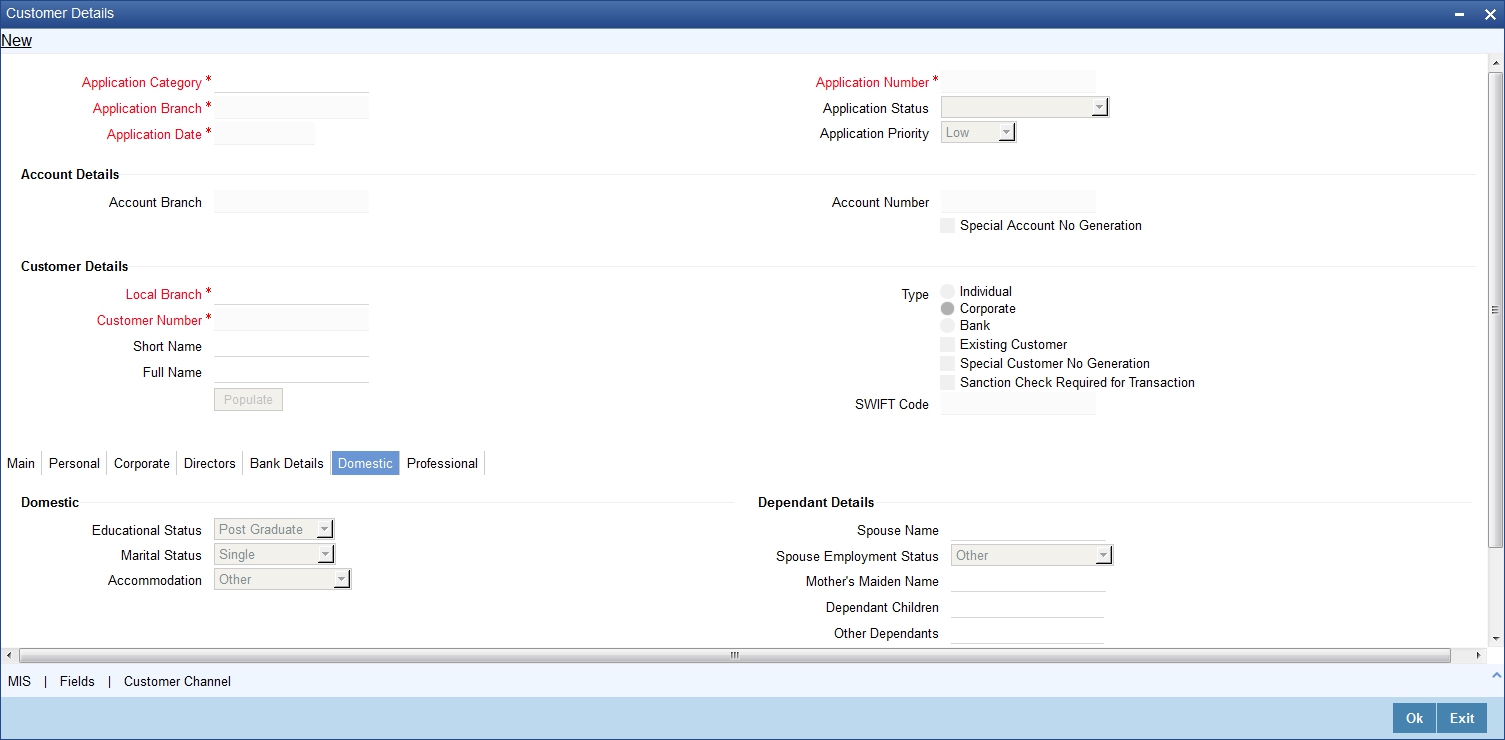

2.5.8 Domestic Tab

Click ‘Domestic’ tab to maintain domestic details.

You maintain the domestic details of the customer here:

Domestic

Educational Status

Select a valid educational status of the customer from the adjoining drop-down list. The list displays the following values:

- Non Student

- Under Graduate

- Graduate

- Post Graduate

Marital Status

Select a valid marital status of the customer from the adjoining drop-down list. The list displays the following values:

- Single

- Married

- Divorced

- Remarried

- Separated

- Spouse Expired

Accommodation

Select a valid type of accommodation of the customer from the adjoining drop-down list. The list displays the following values:

- Self Owned

- Company Provided

- Other

Dependent Details

Spouse Name

Specify the spouse’s name of the customer.

Spouse Employment Status

Select the employment status of the spouse from the adjoining drop-down list. The list displays the following values:

- Full Time Permanent

- Full Time Temporary

- Self Employed

- Unemployed

- Retired Pensioned

- Part Time

- Retired Non Pensioned

- Other

Mother’s Maiden Name

Specify the maiden name of customer’s mother.

Dependent Children

Specify the number of dependant children, if any.

Other Dependants

Specify the number of other dependants, if any.

2.5.9 Professional Tab

Click ‘Professional’ tab to maintain professional details

You can maintain the professional details here:

Professional

Employment Type

Select the employment type of the customer.

Official Address

Address Code

The address code.

Address 1-4

Specify the official address of the customer.

Pin Code

Specify the pin code of the official address.

Country

Specify the country code of the specified official address. The adjoining option list displays all valid country codes. Select the appropriate one.

Employment Details

Tenure

Specify the tenure of the employment.

Retirement Age

Specify the retirement age.

Previous Designation

Specify the previous designation of the customer.

Previous Employer

Specify the name of the previous employer.

Current Designation

Specify the current designation of the customer.

Current Employer

Specify the name of the current employer.

Employer Description

Enter the description of the employer.

Contact

Telephone

Specify the professional telephone number of the customer.

Telex

Specify the professional telex number.

Fax

Specify the professional fax number.

Specify the professional Mail ID of the customer.

Income

Income Currency

Specify the currency code of the income. The adjoining option list displays all valid currency codes. Select the appropriate one

Salary

Specify the salary of the customer.

Other Income

Specify other income of the customer, if any.

Expense

You can specify the expenses of the customer here:

Rent

Specify the rent paid by the customer, if any.

Insurance

Specify the insurance paid by the customer, if any.

Loan Payments

Specify the loan payments paid by the customer, if any.

Other Expense

Specify the other expense paid by the customer, if any.

House Value

Specify the house value owned by the customer, if any.

No of Credit Cards

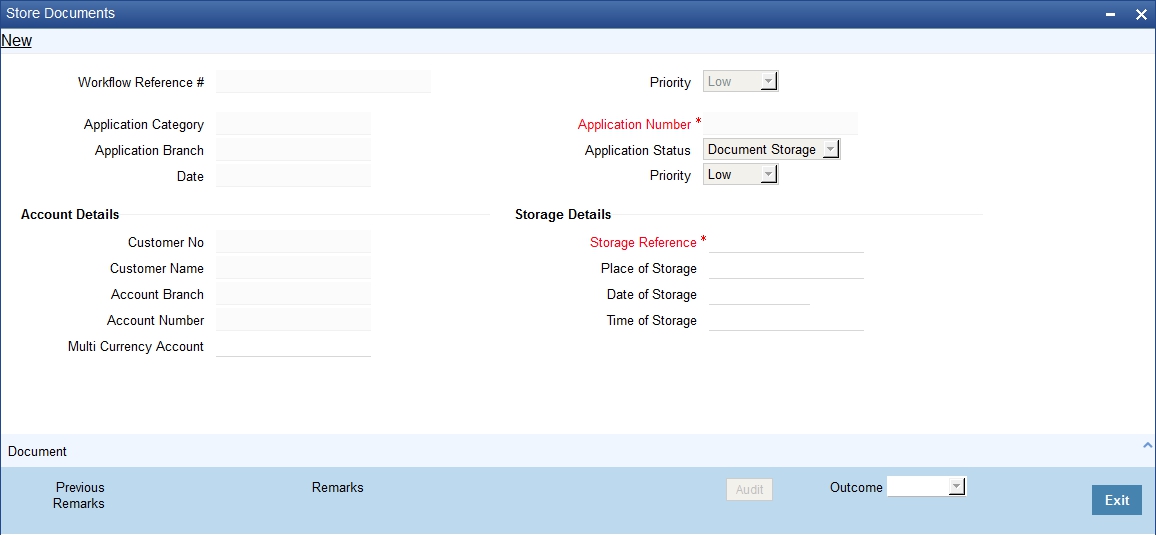

Specify the number of credit cards held by the customer, if any.

2.5.10 Specifying MIS Details

Click ‘MIS’ button to specify the MIS details. The ‘Customer MIS’ screen is displayed:

2.5.11 Specifying User Defined Fields

Click ‘UDF’ button to upload the documents. The ‘User Defined Fields’ screen is displayed:

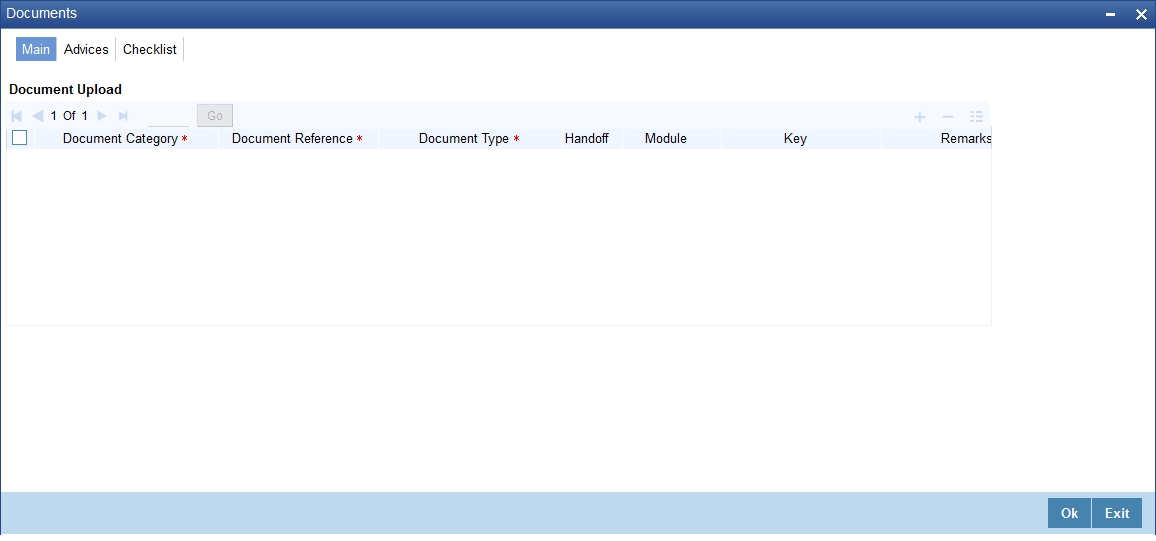

2.5.12 Capturing Document Details

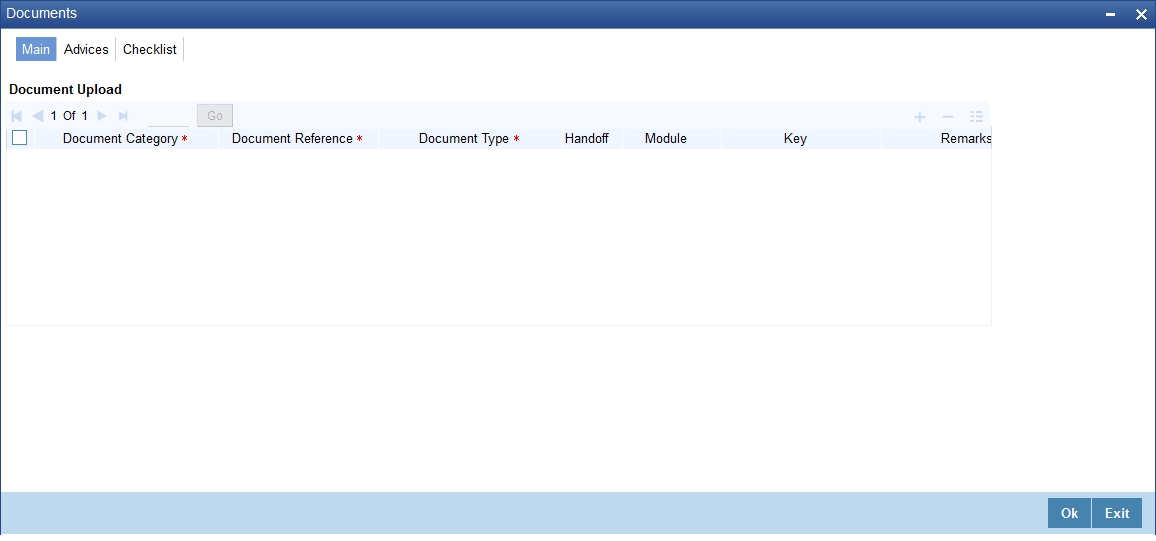

You can capture the customer related documents in central content management repository through the ‘Documents’ screen. Click ‘Documents’ button to invoke this screen.

Here, you need to specify the following details:

Document Category

Specify the category of the document to be uploaded.

Document Reference

The system generates and displays a unique identifier for the document.

Document Type

Specify the type of document that is to be uploaded.

Upload

Click ‘Upload’ button to open the ‘Document Upload’ sub-screen. The ‘Document Upload’ sub-screen is displayed below:

In the ‘Document Upload’ sub-screen, specify the corresponding document path and click the ‘Submit’ button. Once the document is uploaded through the upload button, the system displays the document reference number.

View

Click ‘View’ to view the document uploaded.

When the origination is initiated from channels and the existing customer check box is checked, then there will not be any modifications allowed to customer details in channel except the fields ‘Preferred Date of Contact’ and ‘Preferred Time of Contact’.

You can validate origination from channels using the workflow reference number. During the validation the updated application will be visible to the customer in the submitted format.

In ‘Current Account Creation’ process, ‘Document Upload’ feature is not available in all the stages. Its availability in this process is given below:

Stage Title |

Function Id |

Doc Callform Exists |

Upload (Available/Not Available) |

View (Available/Not Available) |

Receive and account opening form and other documents |

STDCA001 |

Available |

Available |

Available |

Seek approval for missing documents / details |

STDCA002 |

Available |

Available |

Available |

Input details of Current account |

STDCA003 |

Available |

Not Available |

Available |

details of Current account |

STDCA004 |

Available |

Not Available |

Available |

Modify details of Current account |

STDCA005 |

Available |

Not Available |

Available |

Prospect /customer details |

STDKYC01 |

Available |

Not Available |

Available |

Ascertain if KYC checks are required |

STDKYC00 |

Available |

Not Available |

Available |

SDN check |

Subprocess |

|

|

|

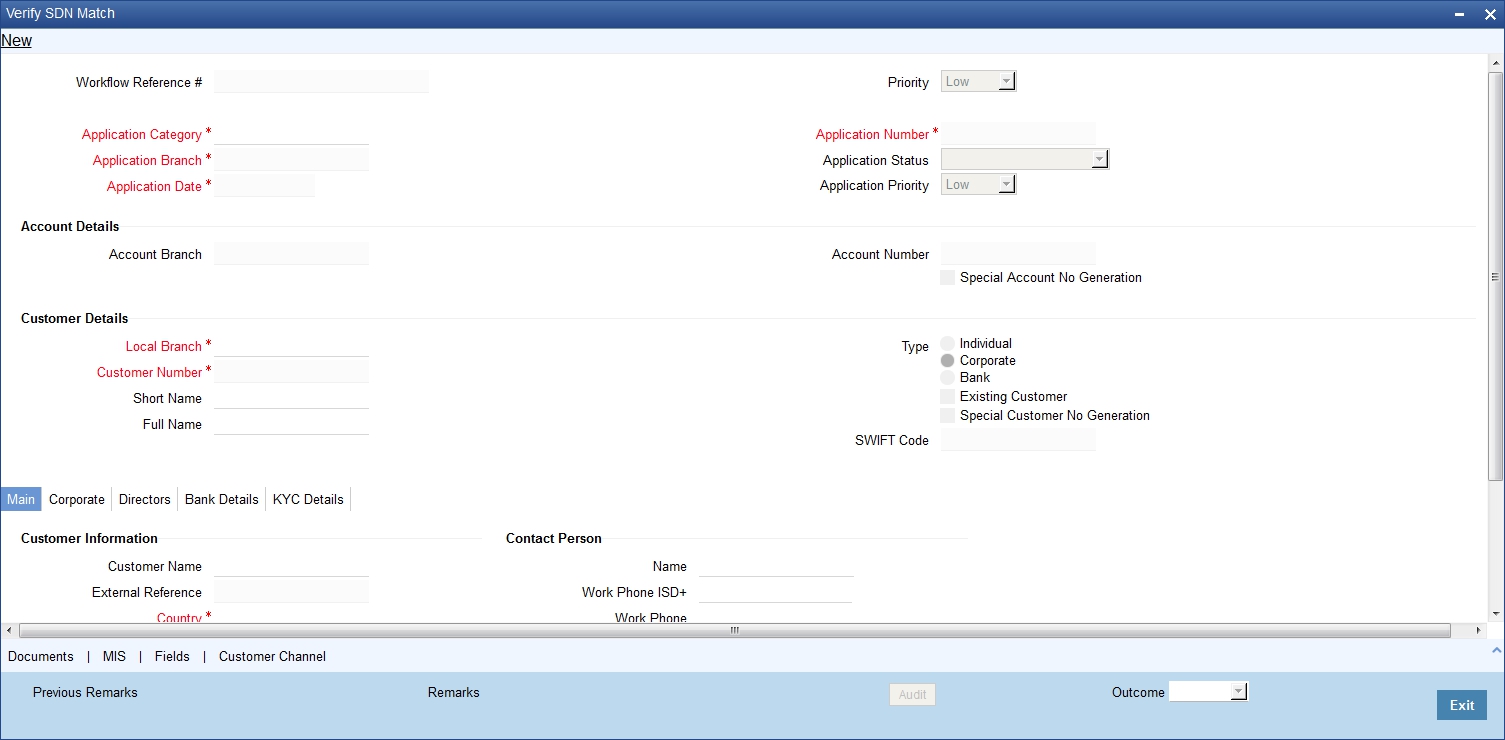

SDN Match |

STDKYC02 |

Available |

Not Available |

Available |

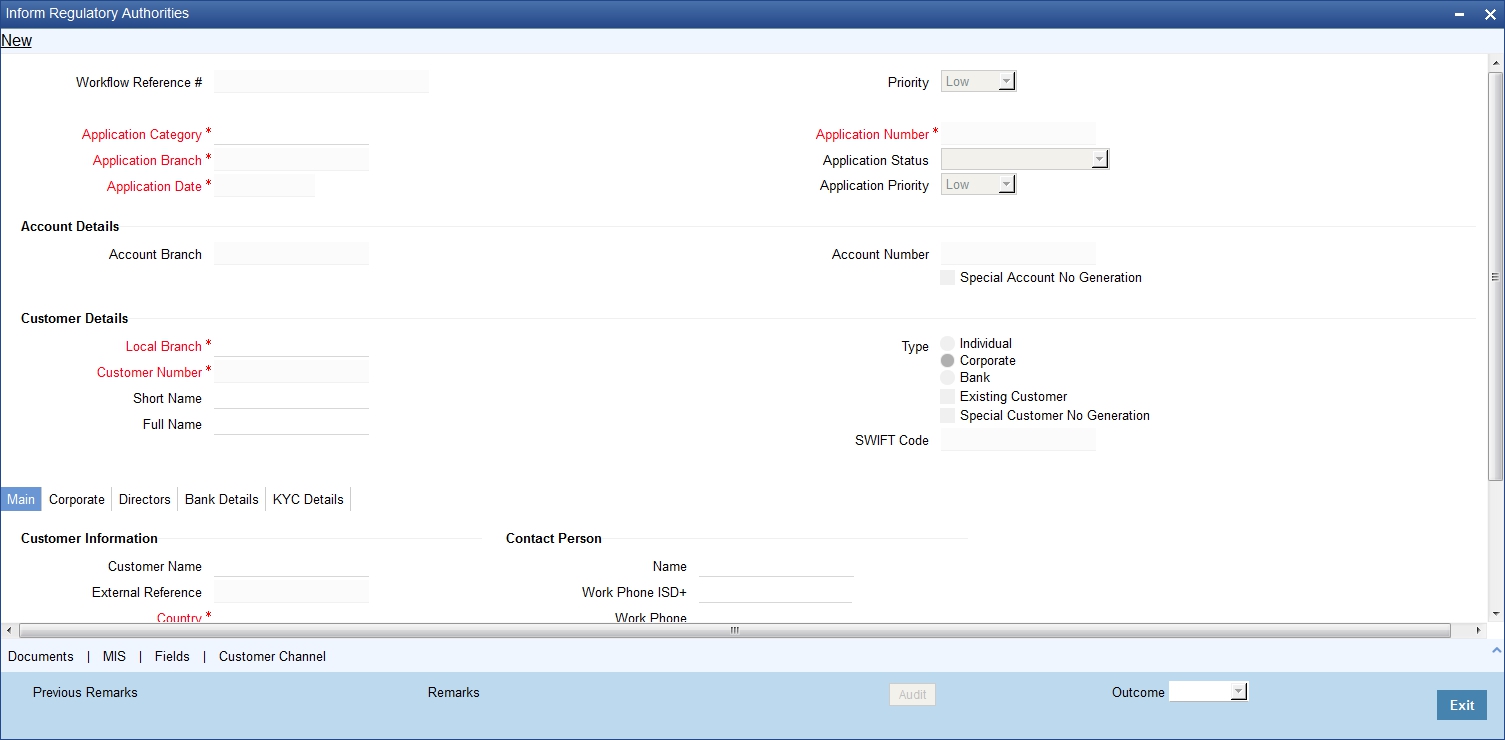

Inform Regulatory / Internal authorities on KYC checks failure |

STDKYC06 |

Available |

Not Available |

Available |

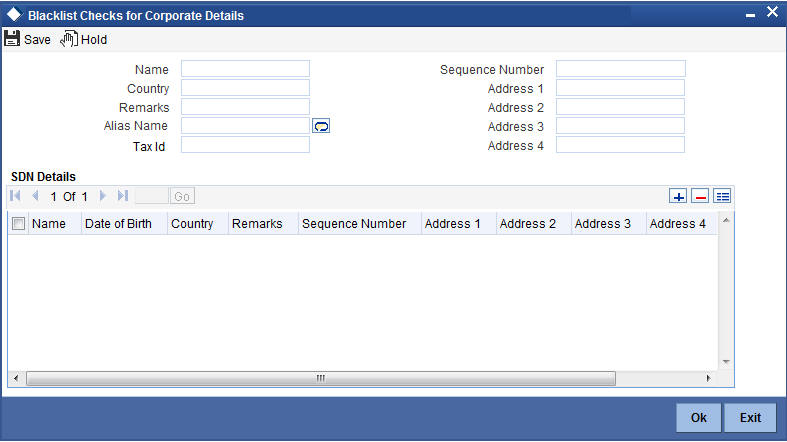

Internal blacklist check |

STDKYC03 |

Available |

Not Available |

Available |

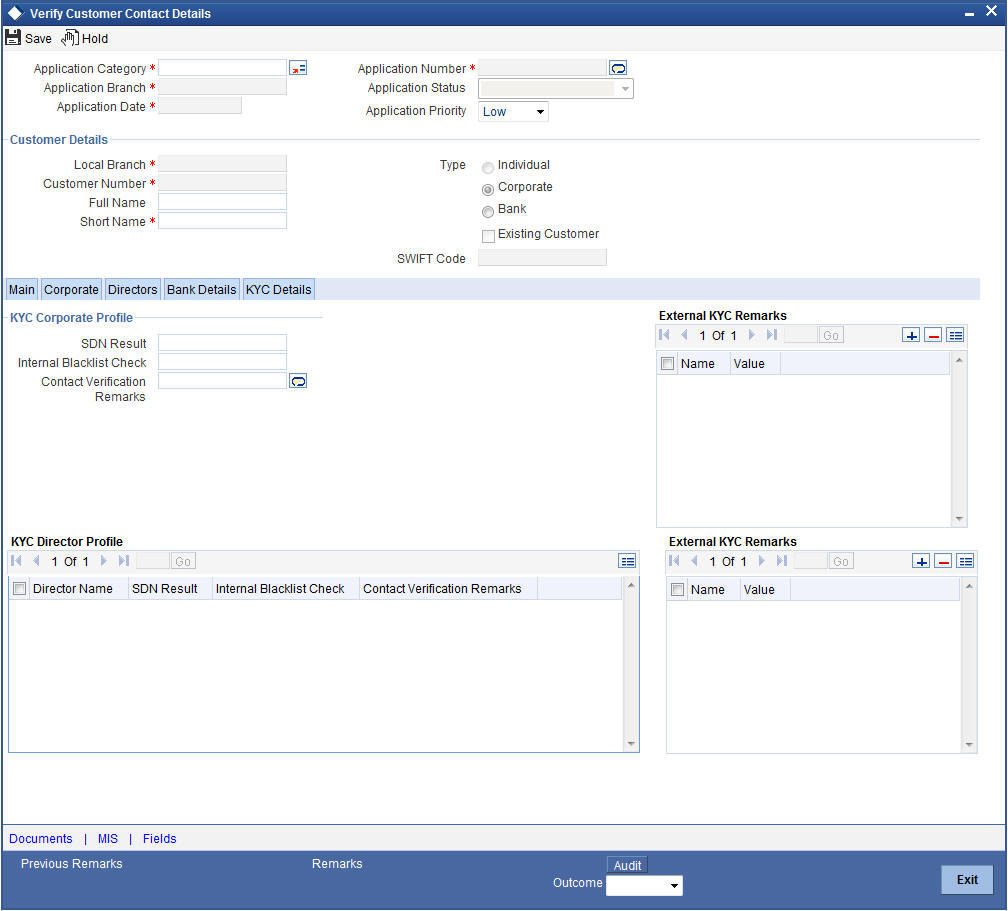

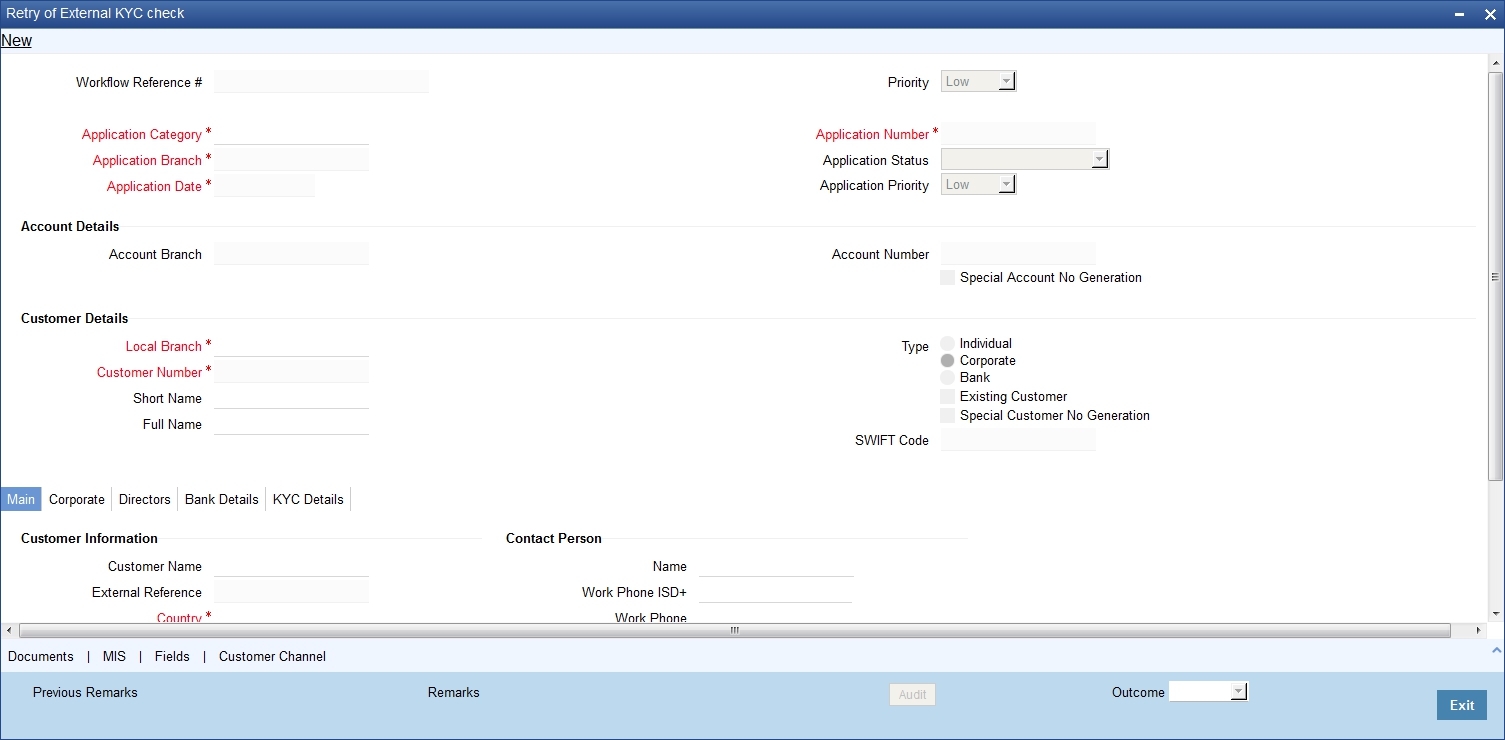

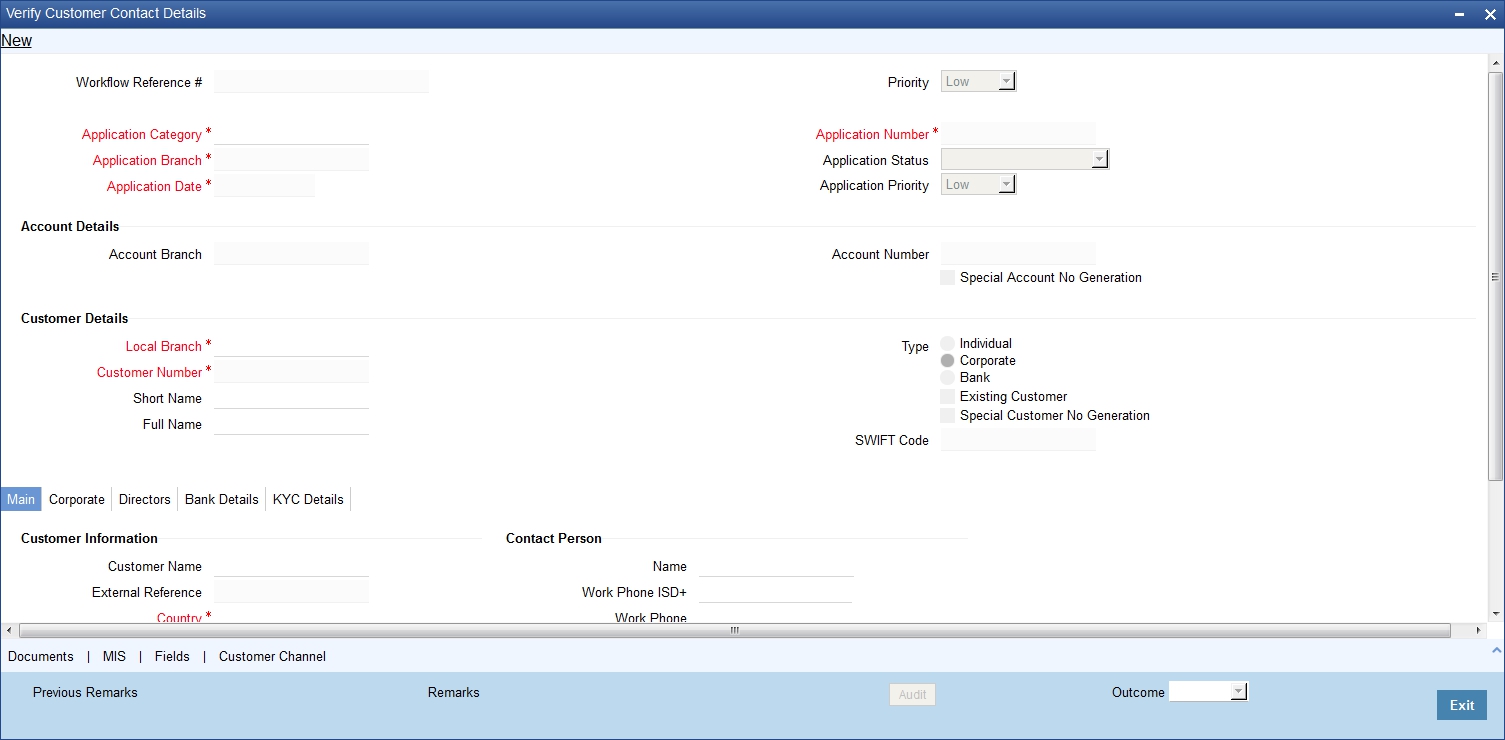

customer / prospect contact details |

STDKYC05 |

Available |

Not Available |

Available |

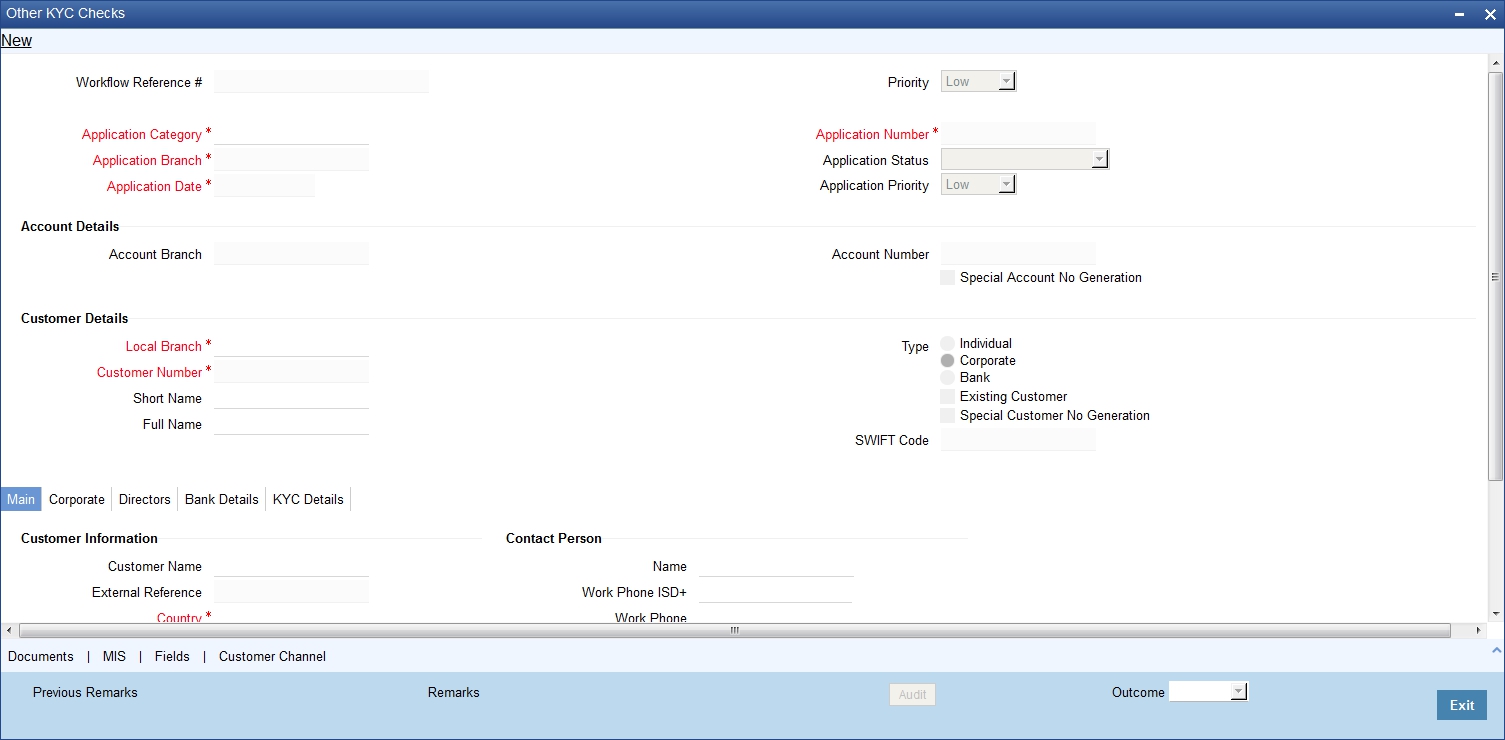

Other KYC Checks |

STDKYC07 |

Available |

Not Available |

Available |

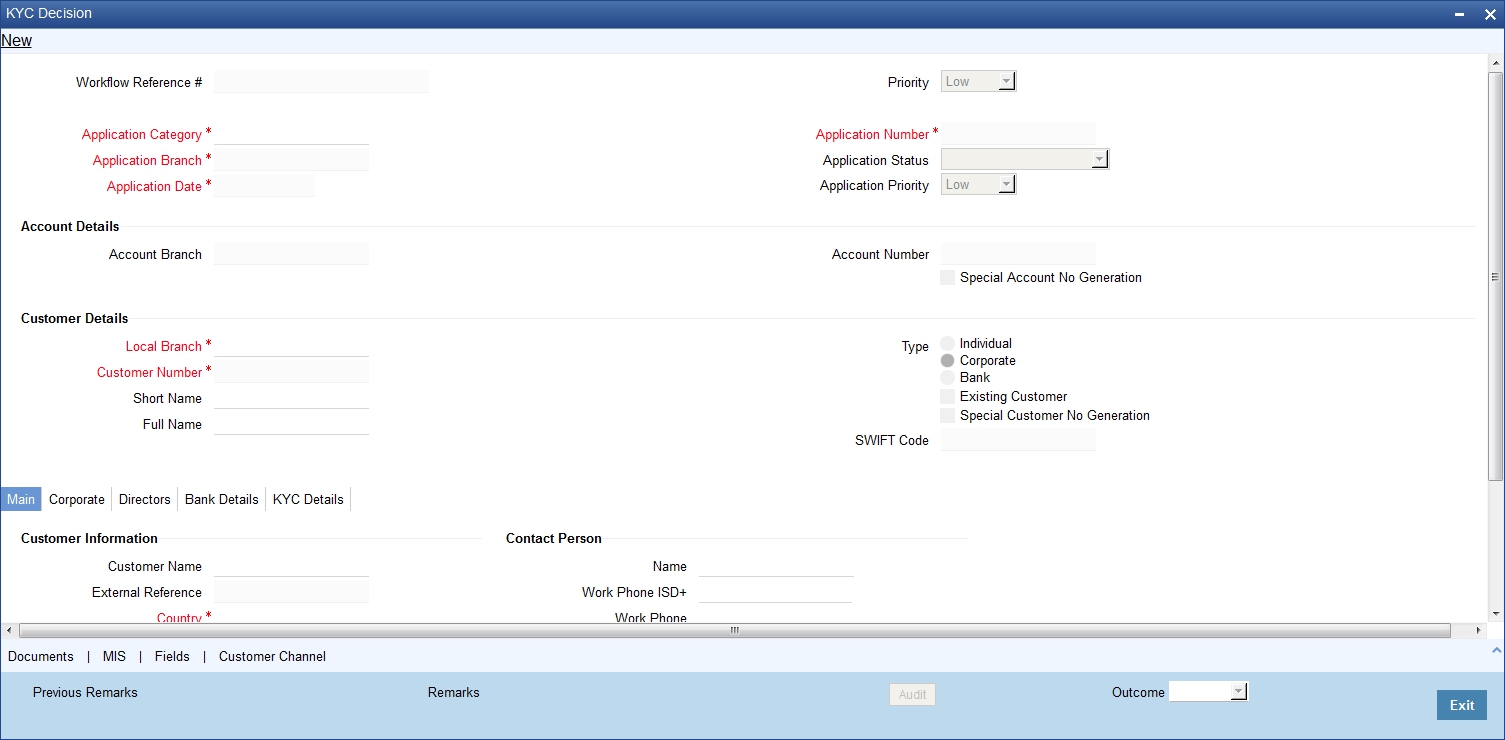

KYC Decision |

STDKYC08 |

Available |

Not Available |

Available |

Sub process – Know your customer checks |

|

|

|

|

Block customer in FLEXCUBE |

STDCA014/STDCA019 |

Available |

Not Available |

Available |

Notify prospect / customer on negative status of KYC checks |

STDCA012/STDCA013 |

Available |

Not Available |

Available |

Create / Modify customer details in FLEXCUBE |

STDCA018 |

Available |

Not Available |

Available |

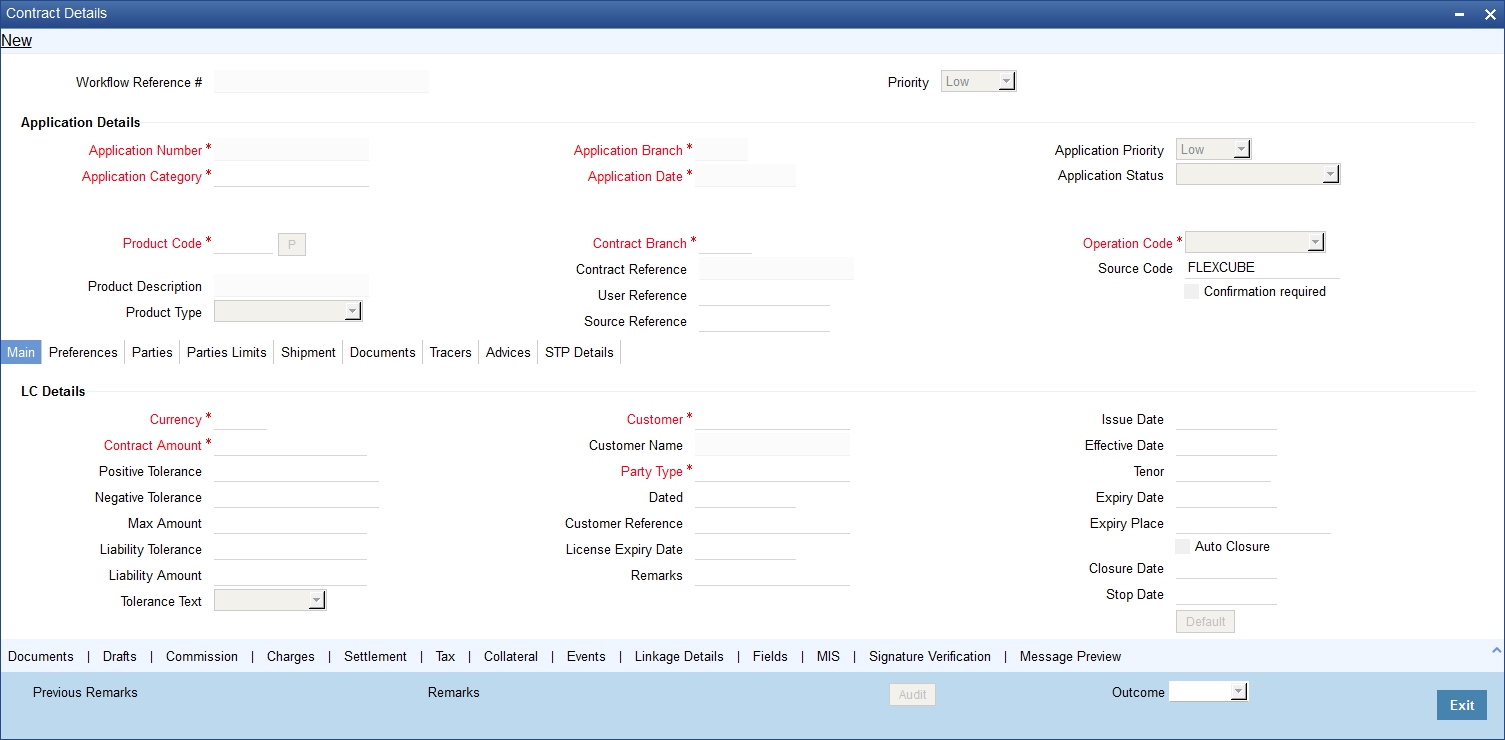

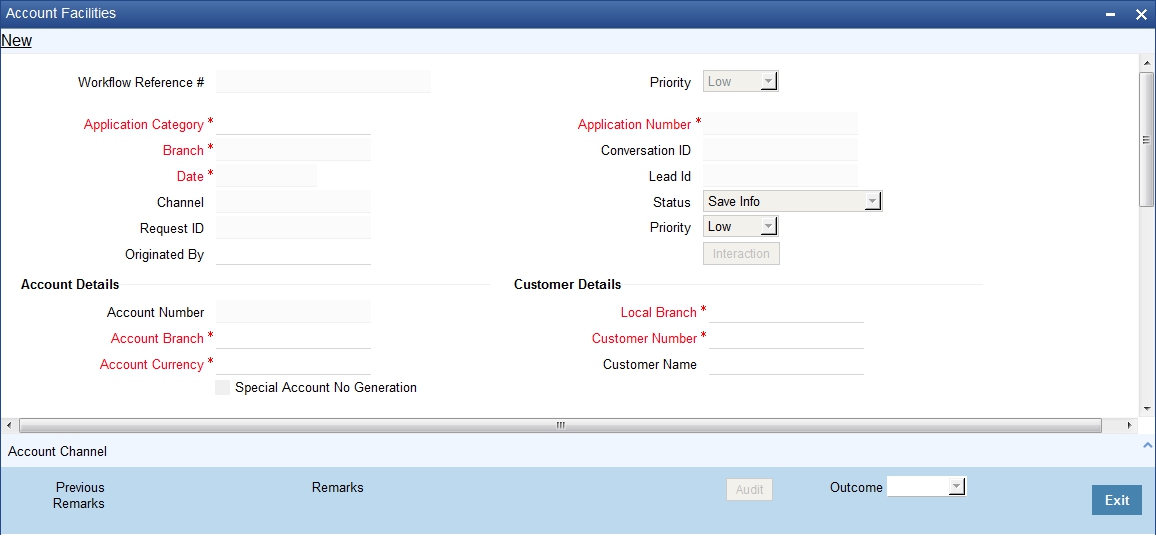

Create account in FLEXCUBE |

STDCA015 |

Available |

Not Available |

Available |

Store document reference in FLEXCUBE |

STDCA010 |

Available |

Not Available |

Available |

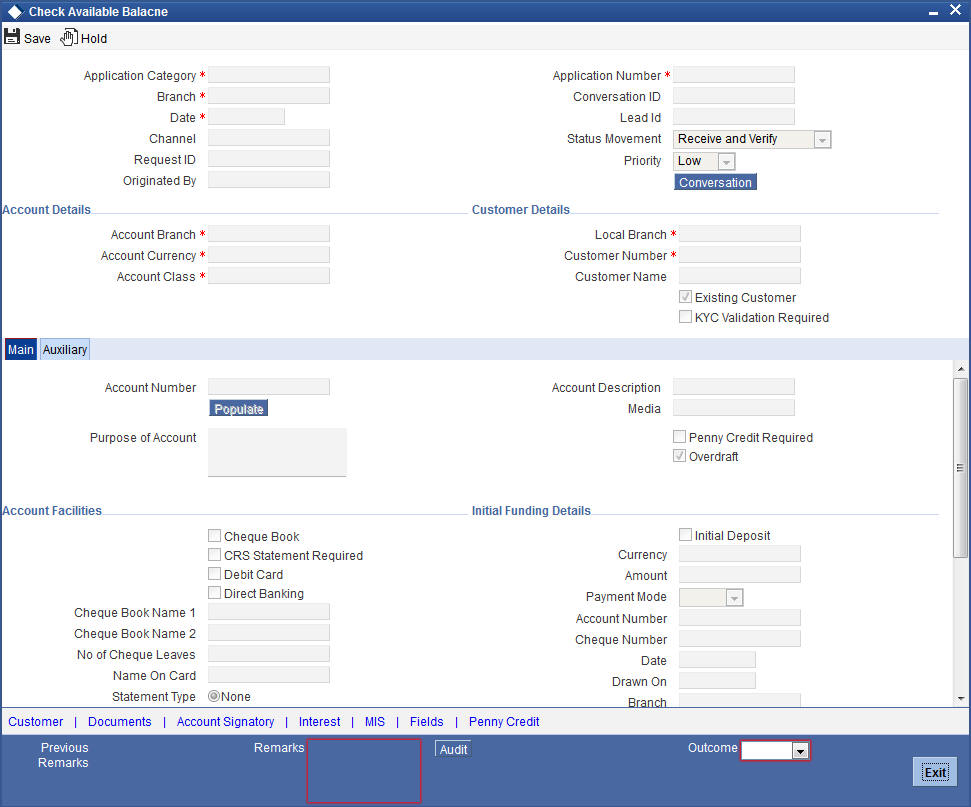

Check available balance |

STDCA006 |

Available |

Not Available |

Available |

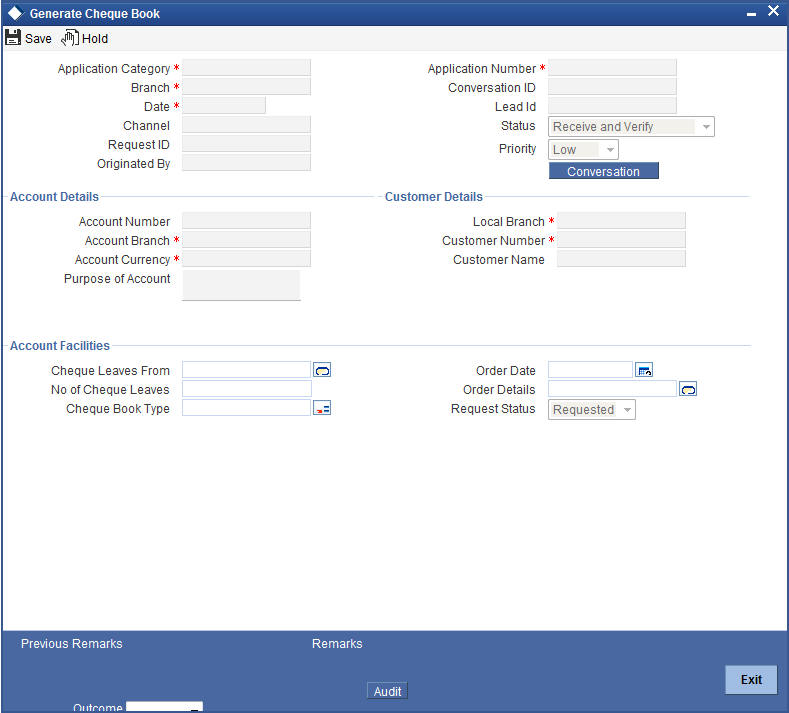

Generate cheque book in FLEXCUBE |

STDCA008 |

Not Available |

|

|

Retrieve preprinted cheque book and capture cheque book details |

STDCA007 |

Not Available |

|

|

Generate welcome / thanks letter in FLEXCUBE |

STDCA016 |

Available |

Not Available |

Available |

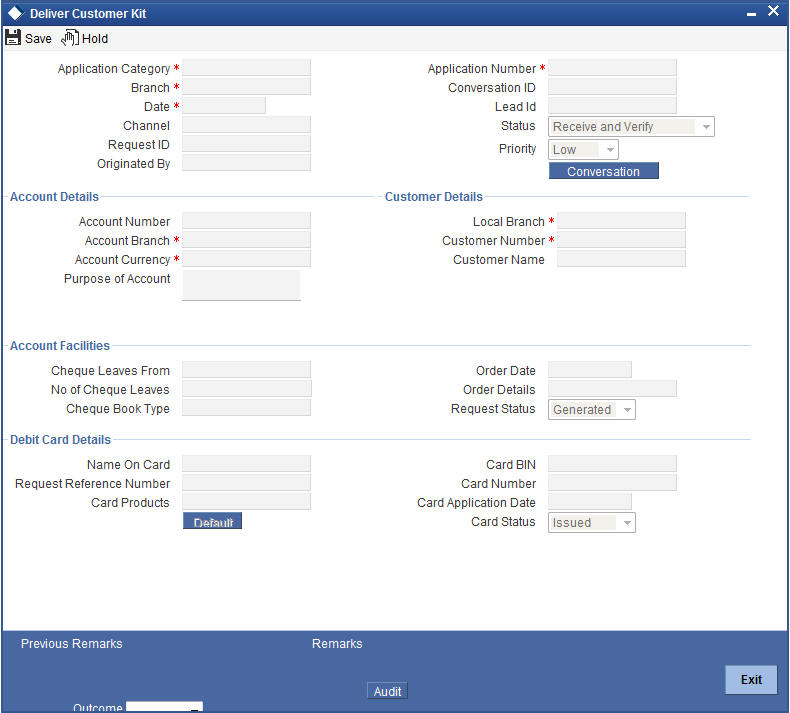

Deliver account kit to customer |

STDCA009 |

Not Available |

|

|

Store documents |

STDCA010 |

Available |

Not Available |

Available |

Refer the Procedures User Manual for details about task list.

2.6 Seek Approval for Missing Documents / Details

In case the documents/details received by the bank from the customer are incomplete, the bank may decide to approve processing the account opening request as an exception and simultaneously arranges to follow up with the customer for submission of the pending details / documents.

Users belonging to the user role ‘CCSMROLE’ (Corporate Customer Service Manager) can perform these activities.

This section contains the following topics:

2.6.1 Acquiring Tasks

Go to the pending list in the system. The system displays all the pending activities. Click ‘Acquire’ button adjoining the ‘Approve Account Opening’ task to acquire it. The system displays the information message as “The task was successfully Acquired!”

If you have requisite rights, double click on the task in your ‘Assigned’ task list. You can invoke the screens, based on the origination of initiation.

2.6.2 Origination Initiated by Oracle FLEXCUBE Branch

The following details from the first stage are displayed on clicking the ‘Populate’ button:

Header Section

- Application Category

- Branch

- Date

- Channel

- Request ID

- Application Number

- Conversation ID

- Lead ID

- Status

Account Details

- Account Branch

- Account Currency

- Account Class

- Purpose of Account

- Overdraft

Customer Details

- Local Branch

- Customer Number

You can specify the following details:

Priority

Select the priority you need to assign to the application from the adjoining drop-down list. This list displays the following values:

- Medium

- Low

- High

Purpose of Account

Specify the purpose for maintaining the account.

After viewing the details, if you want to obtain the missing documents before approval, then select the action ‘Obtain Missing Documents’ in the text box adjoining the ‘Audit’ button. You will be taken back to ‘Receive and ’ screen. However, if you want to proceed with the process of account creation, select the action ‘APPROVE’ in the text box adjoining the ‘Audit’ button. You will be taken to “Input Details’ task. Click save icon in the tool bar. The system displays the information message as “The task is completed successfully”

Click ‘OK’ button in this screen. You will be taken back to the ‘Approve Account Opening’ screen. Click ‘Exit’ button to exit the screen. The task is then moved to the next activity.

You can publish the standard list of documentation for origination workflow process using ‘Document Maintenance’ screen. The system facilitates retrieval of the document checklist defined for a process code that can be utilized by channels for originations.

You can also upload the required documents from channels at the time of application submission. Further document upload will be possible only when the outcome is selected as ‘Rejected’ in this and the application is redirected to application filling stage.

If the submitted application is rejected by the authorizer, then the request is redirected to the application filling stage.

The system stores the documents uploaded by the customer/prospect through the channel in the document management system. When the request is raised from the branch the documents uploaded will be stored in the document management system.

2.7 Modifying and Resubmit the Application

In this stage the Customer/Prospect can modify and resubmit the application if the Bank user rejects the application due to any reasons.

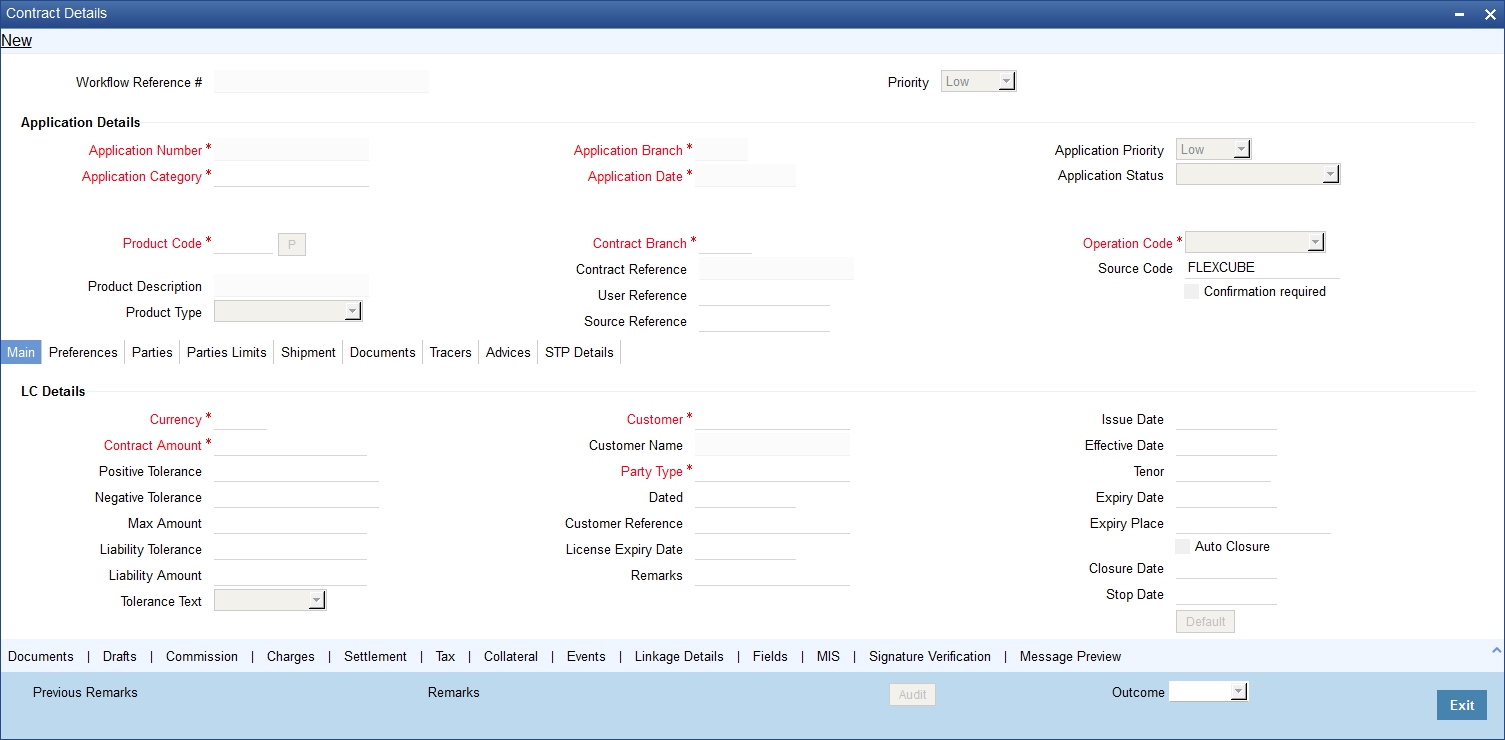

2.8 Input Details of Current Account

Users belonging to the user role ‘COEROLE’ (Corporate Operations Executive) can perform these activities.

This section contains the following topics:

- Section 2.8.1, "Input Details"

- Section 2.8.3, "Capturing Interest Details"

- Section 2.8.4, "Capturing MIS Details"

- Section 2.8.5, "Capturing Customer Details"

- Section 2.8.6, "Specifying Corporate Details."

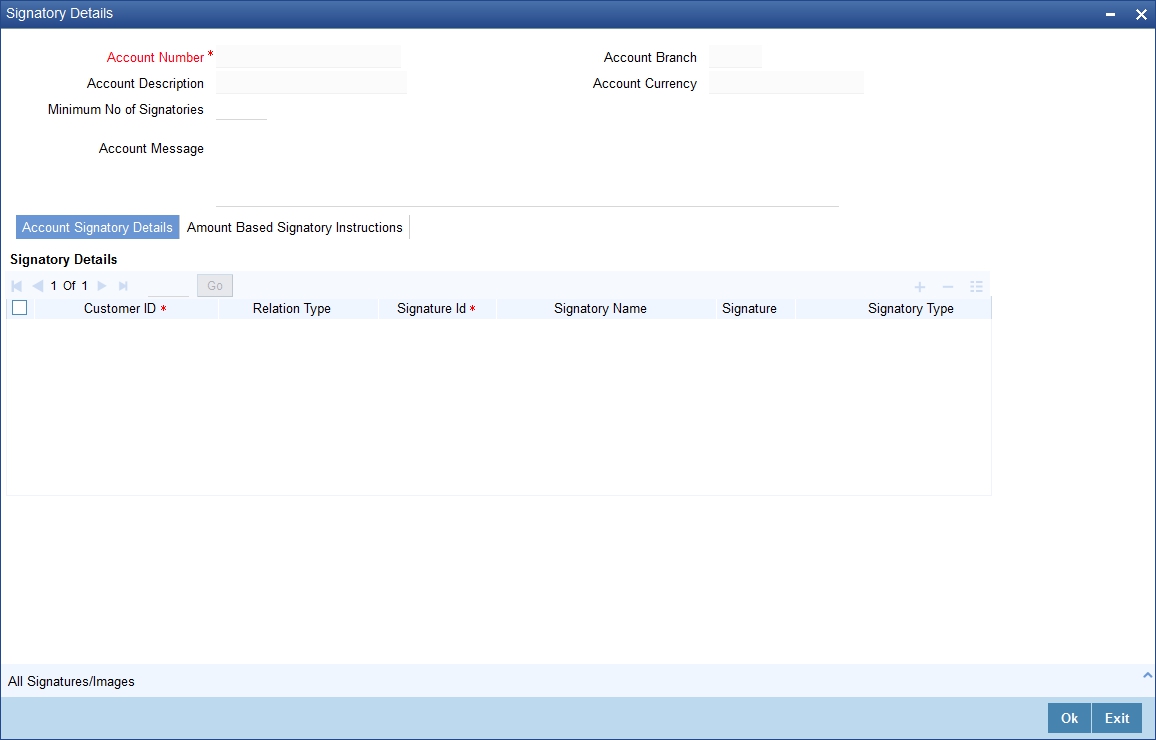

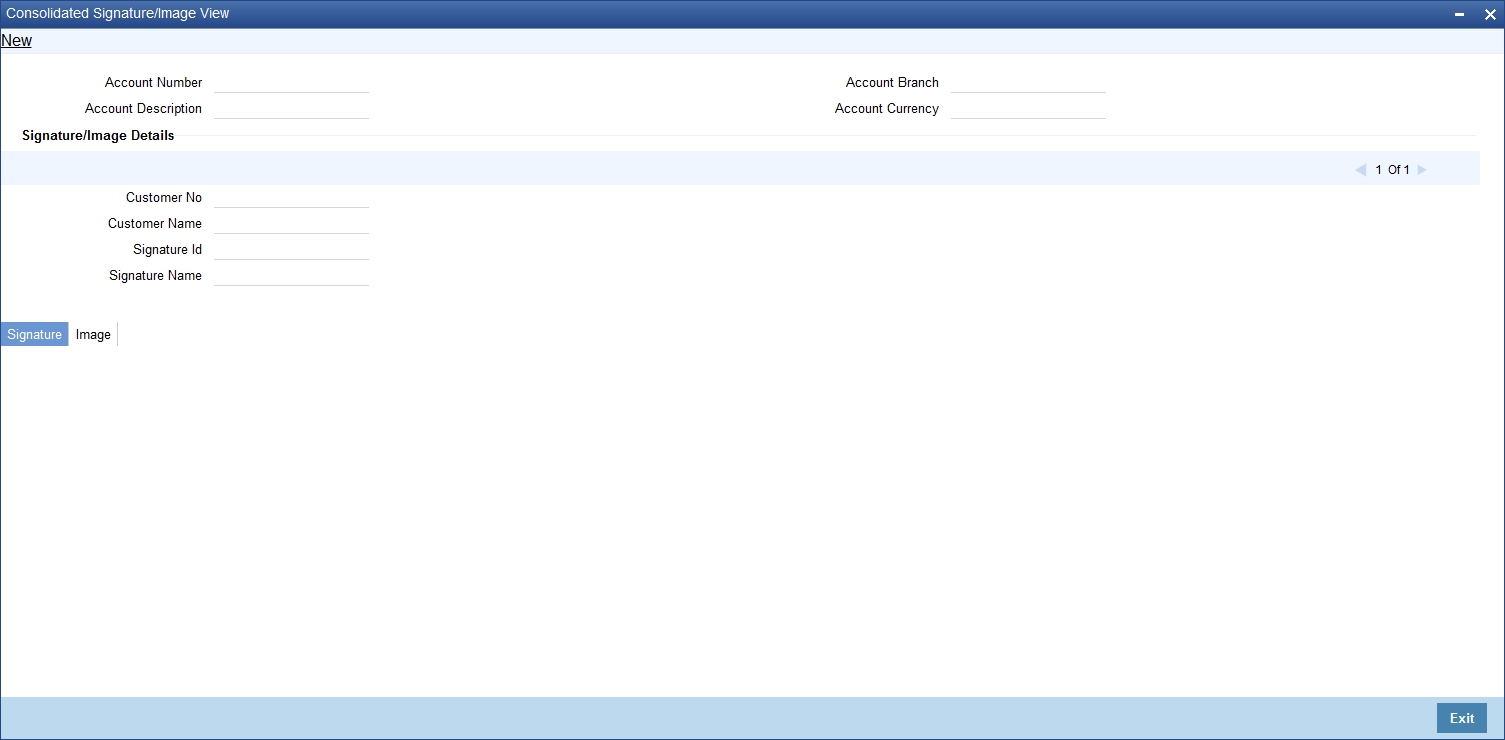

- Section 2.8.7, "Capturing Signatory Details"

2.8.1 Input Details

Go to the pending list in the system. The system displays all the pending activities. Click ‘Acquire’ button adjoining the ‘Input Details’ task to acquire it. The system displays the information message as “The task was successfully Acquired!”.

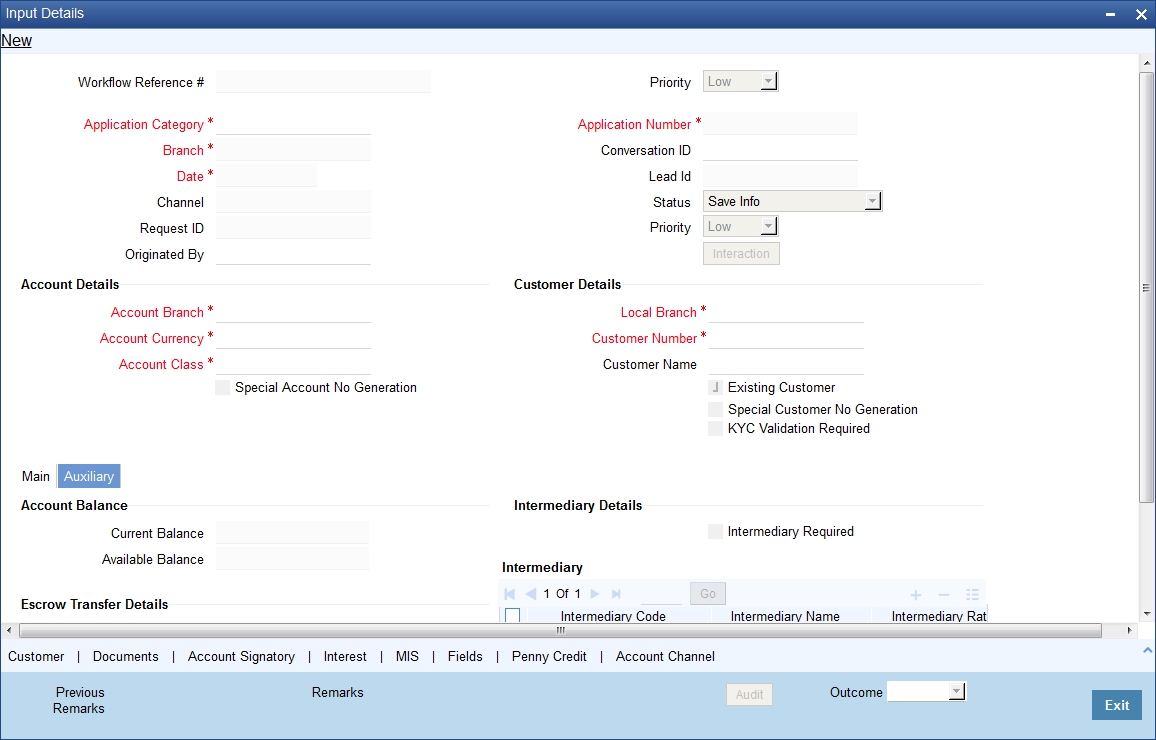

If you have requisite rights, double click on the task in your ‘Assigned’ task list and invoke the following screen:

Here you can specify the following details:

Account Details

The following details from the first stage are displayed on clicking the ‘P’ button next to the ‘Account Class’ field:

- Customer No

- Customer Name

- Existing Customer

- Account Class

Specify the following account details in this section:

Currency

Specify the currency to be used for the account. You can also select the account currency from the adjacent option list. The list displays all the currencies maintained in the system.

Media

Specify the media i.e the mode of communication to be used. It can either be through SWIFT, mail, fax etc. You can also select the media from the option list provided. The list displays all the media maintained in the system. Select and click the appropriate media.

Account Balance

Specify the account balance details in this section.

Current Balance

Specify the current balance of the account holder.

Available Balance

Specify the available balance of the account holder.

Note

The initial deposit details are captured here only for the sake of information. These details are not used for processing.

Account Facilities:

Cheque Book

Check this box if the customer requires the check book facility.

CRS Statement Required

Check this box to indicate that the CRS statement is required.

Debit Card

Check this box if the customer needs a debit card.

Direct Banking

Check this box if the customer needs direct banking facility.

Auto Reorder of Cheque book

Check this box if you want to automatically re-order cheque book.

Reorder Cheque level

Enter the level of cheque to reorder.

Reorder No of Leaves

Enter the number of leaves in the cheque to reorder.

Cheque Book Name1 and 2

Specify the name customer prefers on the check book.

Cheque Leaves From

The page number of cheque leaves, from whcih you want to order.

No of Cheque Leaves

Specify the number of check leaves customer needs.

Name on Card

Specify the name customer prefers on the debit card. If you have checked the ‘Debit Card’ check box, then it is mandatory to provide these details.

Order Date

The date on which the cheque book was ordered.

Max No. of Cheque Rejections

Enter the maximum number of rejections for cheque book.

Auto Cheque Book Request

Check this box if you want to automatically request cheque book.

Order Details

The order details of the cheque book.

Request Status

The status of the cheque book request.

Cheque Book Type

The type od cheque book ordered.

Options

IBAN Required

Check this box if you want to automatically request IBAN details.

IBAN Account Number

The IBAN Account number of the customer account.

IBAN Multi Currency Account

The IBAN Multi Currency Account of the Multi Currency Customer Account.

Account Statement Parameter

Statement Type

Select a valid statement type from the options. The following options are available for selection:

- None

- Summary

- Detailed

Statement Cycle

Select a valid cycle statement from the adjoining drop-down list. This list displays the following options:

- Annual

- Semi Annual

- Quarterly

- Monthly

- Fortnightly

- Weekly

- Daily

On

Specify the Month, Date or Day for the statement generation.

Statement of Fees Parameters

Statement of Fees Required

Check this box if a statement of fees is required for the account.

Cycle

The cycle of statement generation. Select the value from the dropdown list. The options are:

- Semi Annual

- Quarterly

- Monthly

- Fortnightly

- Weekly

- Daily

- Annual

On

Select the day of statement generation from the dropdown list.

Delivery Channel

Select the various delivery methods for the statement from the dropdown list. The available options are:

- Postal

- Deliver to Branch

- Internet banking

- No printing

Address Details

Address Code

Enter the address code.

Address Line 1 to 4

Specify the address of the customer in four lines starting from Address Line 1 to Address Line 4.

Pincode

The postal code.

Location

The customer’s location

Country Code

The customer’s country code.

Sanction Check Details

Requested Date

The system displays the date when the sanc tion check request is send.

Response Date

The system displays the date when the response is updated from the external system.

Sanction Check Status

The system displays the sanction check response status.

2.8.2 Auxiliary Tab

Account Balance

Current Balance

System displays the current balance of the account.

Available Balance

System displays the available balance of the account.

Intermediary Details

Intermediary Required

Check this box to indicate that the intermediary details have to be provided for the customer.

Escrow Transfer Details

Escrow Transfer Applicable

Check this box to indicate that the escrow transfer is applicable for this account.

Branch Code

Specify the escrow branch code.

Escrow Account

Specify the escrow account number.

Escrow Percentage

Specify the escrow percentage for the account.

Intermediary

Intermediary Code

Specify the intermediary code from the adjoining option list.

Intermediary Name

System displays the intermediary name.

Intermediary Ratio

Specify the intermediary ratio to be divided among intermediaries in case of more than one intermediary.

Note

In case of one intermediary, the ratio will be 100%.

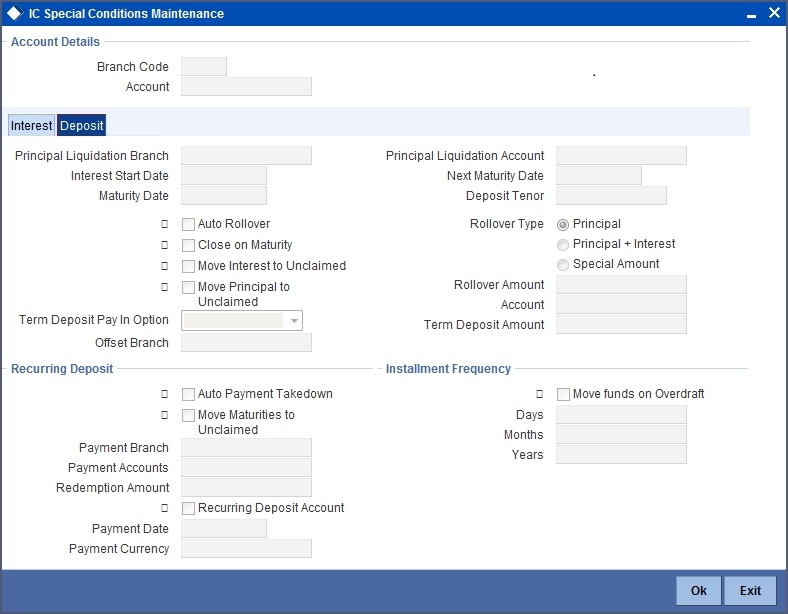

2.8.3 Capturing Interest Details

Enter interest details by invoking the ‘Interest Screen’. Click ‘Interest’ button to invoke this screen.

Refer the ‘Applying Interest Product on Account’ chapter in the ‘Interest and Charges’ User Manual for details about applying interest to an account.

2.8.4 Capturing MIS Details

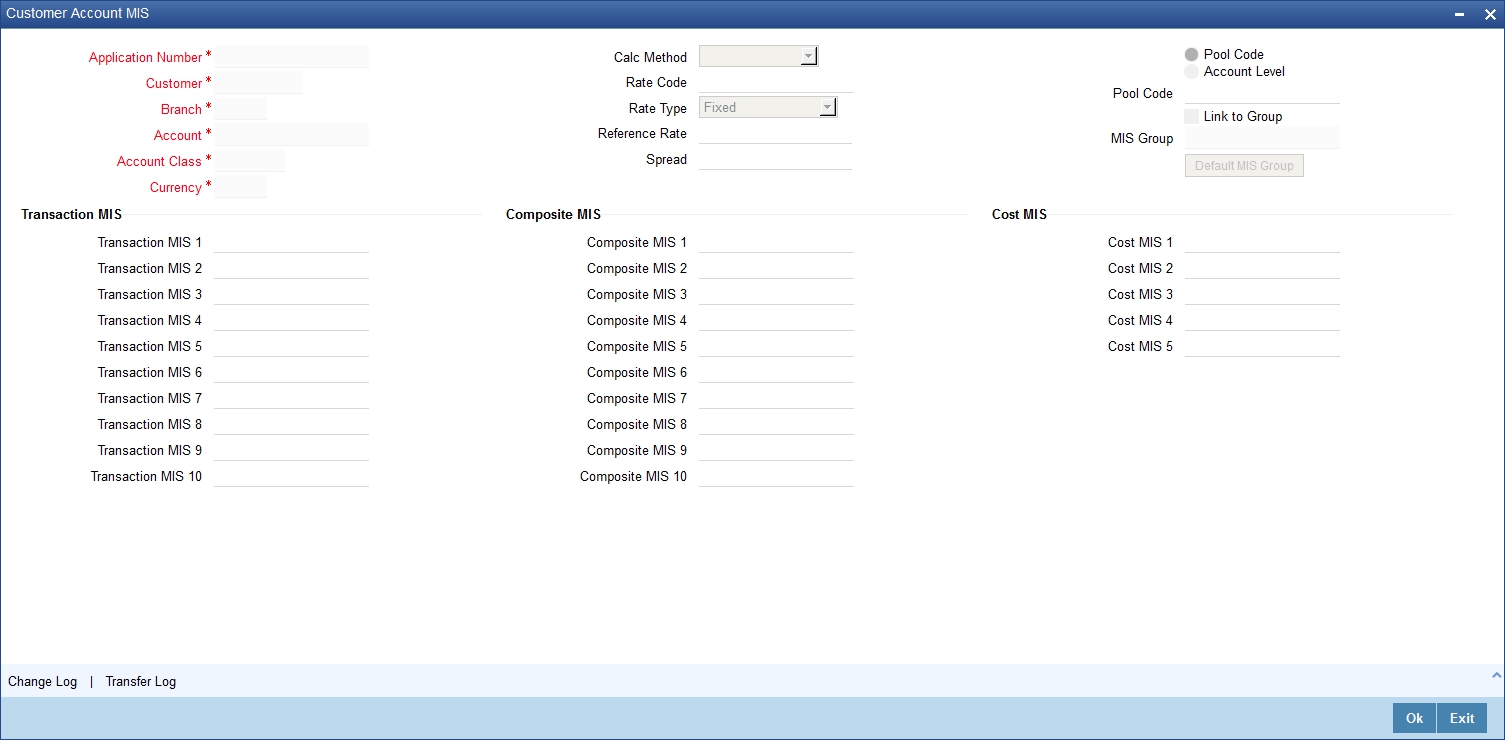

Click ‘MIS’ button to invoke MIS screen. The screen is displayed below:

Refer the Management Information System User Manual for further details.

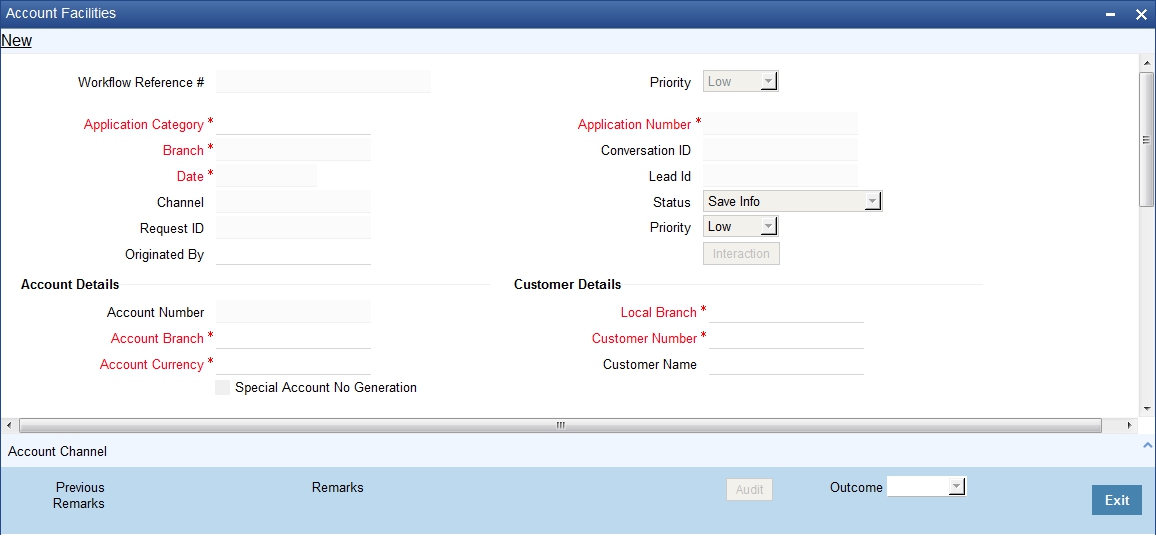

2.8.5 Capturing Customer Details

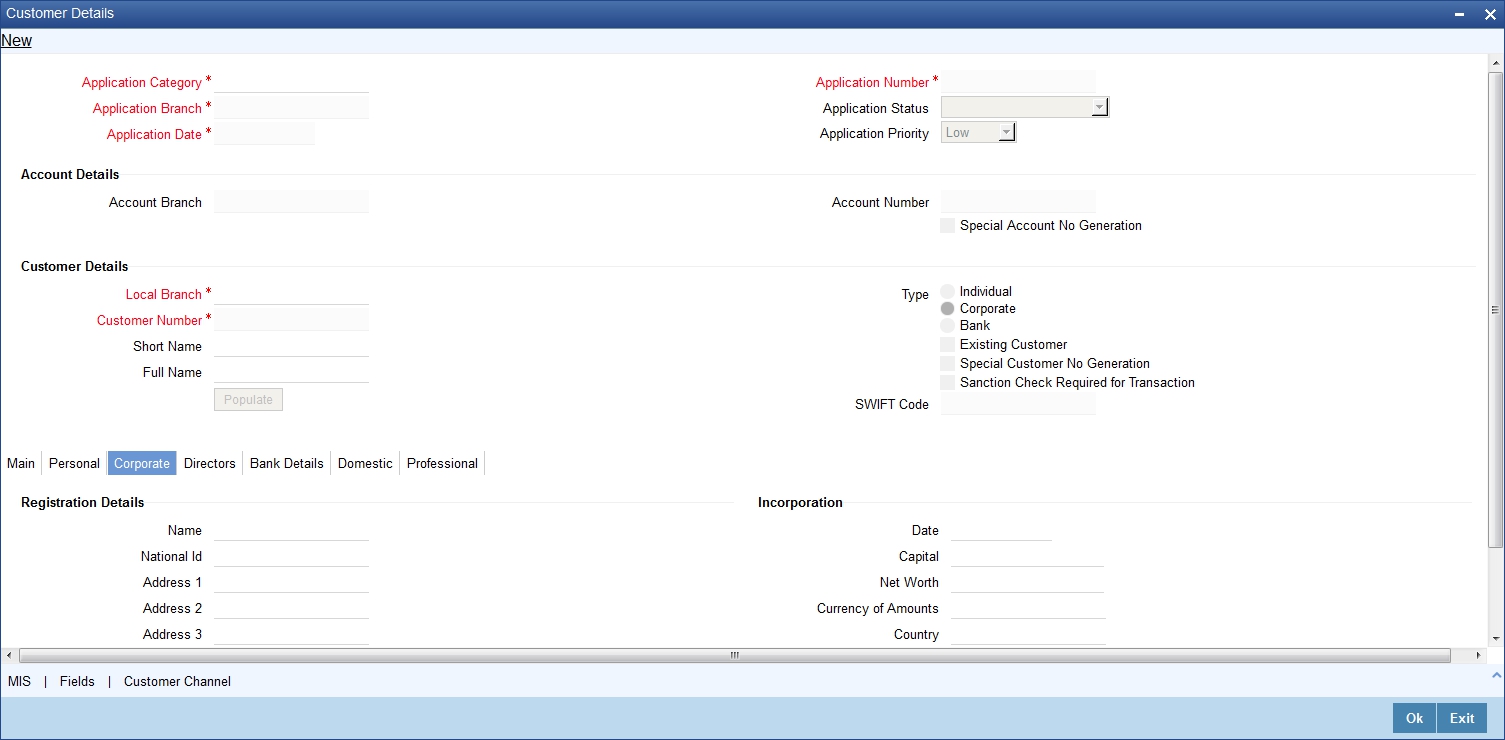

Click the ‘Customer’ button to invoke the ‘Customer Details’ screen. The screen is displayed below:

In this screen maintain the following customer details:

Customer Information

In this section, specify the basic information of the customer.

Customer Number

Specify the customer number for whom the current account is being created. You can also select the appropriate customer from the adjacent option list. The list displays all the valid and authorized customers maintained in the system.

Full name

The full name of the selected customer is displayed.

Short Name

Along with the Customer Code you have to capture the customer’s abbreviated name. The description that you capture is unique for each customer. It helps in conducting a quick alpha-search or generating queries regarding the customer.

Existing Customer

If the customer is the existing customer, then this field is checked and you cannot edit the same.

Country

Specify the country in which the customer resides. You can also select the appropriate country from the adjacent option list. The list displays a list of countries maintained in the system.

Nationality

Specify the nationality of the customer. You can also select the nationality of the customer from the adjacent option list. The list displays a list of countries maintained in the system.

Language

As part of maintaining customer accounts and transacting on behalf of your customer, you will need to send periodic updates to your customers in the form of advices, statement of accounts and so on.

Indicate the language in which your customer wants the statements and advices to be generated.

Customer Category

Specify the category in which the customer belongs. You can also select the appropriate customer category from the adjacent option list and indicate the category under which the particular customer is categorized. Each customer that you maintain can be categorized under any one of the categories that you have maintained in the system.

Click ‘Main’ tab to input the following contact details of the customer:

- Name

- Telephone Number

- Email ID

- Address

Existing Bank Account Details

If the customer is an existing bank customer, then specify the following details:

Bank Name

Specify the name of the bank in which the customer is holding an account.

Branch

Indicate the name of the bank’s branch in which the customer is holding an account.

Account Type

Specify the type of account the customer is holding.

- Corporate

- Bank

Contact Person

In this section, indicate the contact person’s details of the current account being created. Specify the following details:

Name

Specify the name of the contact person.

Work Phone ISD+

Specify a valid international dialling code for the work telephone number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Work Phone

Specify the work telephone number of the customer.

Home Phone ISD+

Specify a valid international dialling code for the home telephone number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Home Phone

Specify the home telephone number of the customer.

Mobile ISD Code+

Specify the international dialling code for the mobile number of the customer. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Mobile Number

Specify the mobile number of the corresponding customer.

Specify the e-mail id of the contact person.

Contact Address

Address

Specify the address of the contact person.

Zip

Specify the Zip code of the contact person’s address.

Country

Specify the country name of the contact person.

Statuses

Private Customer

Check this box to indicate that the customer is a private type of customer.

Permanent US Resident Status

Check this box to indicate that the corresponding director is a permanent US resident.

Visited US in last 3 years?

Check this box to indicate that the beneficial owner has visited US in the last three years.

Eligible for AR -AP Tracking

Check this box to indicate that account receivable and payable process is to be enabled for the corresponding customer.

Power of Attorney

Note

If the FATCA is enabled at the bank and the check box 'Power of Attorney' is checked here, then it is mandatory to specify the Power of Attorney information.

Power of Attorney

Check this box to indicate that the customer account is to be operated by the power of attorney holder.

Holder Name

The person who has been given the power of attorney.

Address

Specify the address of the power of attorney holder.

Country

Specify the country of the power of attorney holder.

Nationality

Specify the nationality of the power of attorney holder.

Telephone ISD Code +

Specify the international dialling code for the telephone number of the power of attorney holder. The adjoining option list displays valid ISD codes maintained in the system. Select the appropriate one.

Telephone Number

Specify the telephone number of the power of attorney holder.

2.8.6 Specifying Corporate Details.

Here, specify the following details of the corporate:

Registration Address

Specify the registration address details of the corporate.

Country

Specify the country where the corporate is registered. You can also select the appropriate country from the adjacent option list. The list displays all the valid countries maintained in the system.

Name

Specify the full name of the main office of the Corporate/Bank customer.

National ID

Specify the corporate National Identification Number of this customer, in other words the registration number of your customer organization.

Address

Specify the address of the customer.

Description of Business

Specify the nature of the business and the business activities carried out by the customer organization.

Incorporation

Specify the following incorporation details of the corporate:

Date

Specify the date on which the customer’s company was registered as an organization.

Capital

Specify the capital of the corporate.

Net Worth

Specify the net worth of the corporate.

Currency of Amounts

Specify the currency in which you specify the particular customer’s various financial details like the Net worth of the customer organization, the total Paid Up capital etc.

Country

Specify the country in which the corporate is incorporated.